Crescent Capital BDC, Inc. Announces Revision in Its Stock Evaluation Amid Financial Challenges

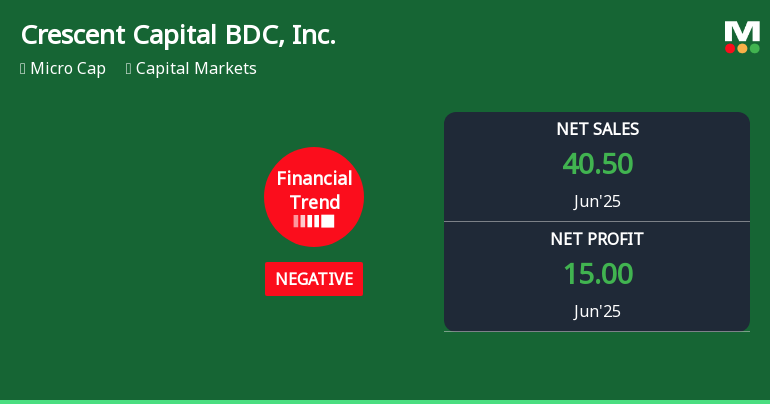

2025-11-19 15:42:55Crescent Capital BDC, Inc. reported a notable decline in net profit for the quarter ending June 2025, alongside a low debtor's turnover ratio. Despite these challenges, the company maintains a high dividend payout ratio and a strong cash position, while its stock has underperformed compared to the S&P 500.

Read full news article

Crescent Capital BDC Hits New 52-Week Low at $13.16

2025-11-18 16:59:13Crescent Capital BDC, Inc. has reached a new 52-week low, reflecting a significant decline over the past year. The company, with a market capitalization of USD 588 million, faces challenges such as a substantial net profit drop and decreased net sales, yet maintains a high dividend yield and increased stakeholder ownership.

Read full news article

Crescent Capital BDC Hits New 52-Week Low at $13.30

2025-11-17 16:42:11Crescent Capital BDC, Inc. has hit a new 52-week low, reflecting a 28.14% decline over the past year. The company reported a significant net profit drop and decreased net sales, while its financial metrics indicate potential market interest. A recent increase in insider ownership suggests some confidence in future prospects.

Read full news article