Key Events This Week

Jan 27: Stock plunges to lower circuit at Rs.67.95 (-4.97%) amid heavy selling pressure

Jan 28: Price stabilises at Rs.67.95 with no change

Jan 29: Hits upper circuit at Rs.71.30 (+4.93%) on strong buying interest

Jan 30: Week closes at Rs.74.75 (+4.84%) with modest volume

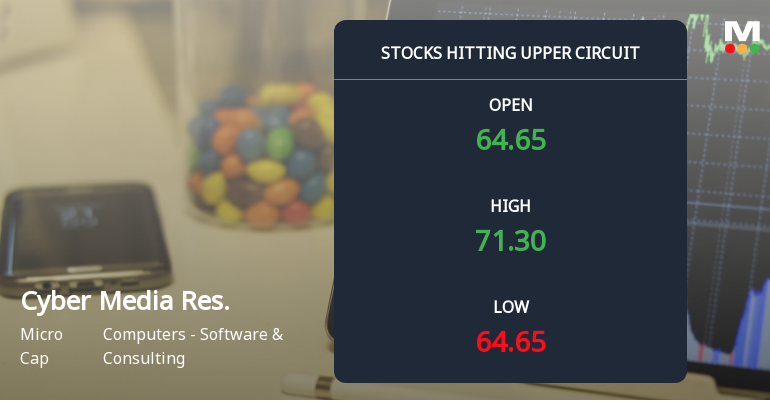

Cyber Media Research & Services Ltd Hits Upper Circuit Amid Strong Buying Pressure

2026-01-29 12:00:15Cyber Media Research & Services Ltd witnessed a robust surge in its share price on 29 Jan 2026, hitting the upper circuit limit of 5%, closing at ₹71.30. This sharp rally was driven by intense buying interest, resulting in a maximum daily gain of 4.93%, significantly outperforming its sector and the broader market indices.

Read full news article

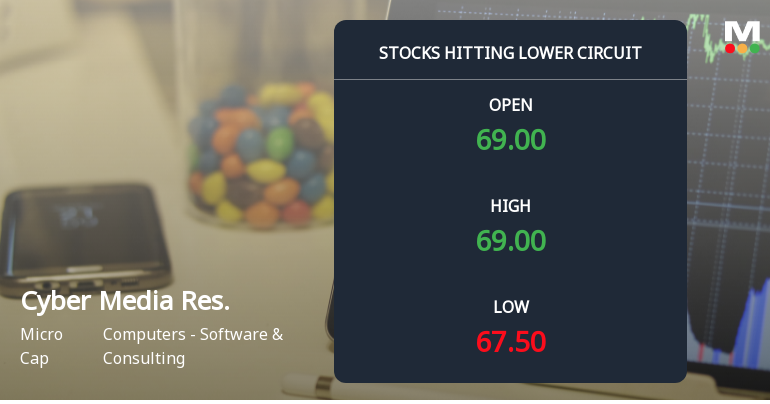

Cyber Media Research & Services Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

2026-01-27 15:00:15Shares of Cyber Media Research & Services Ltd plunged to their lower circuit limit on 27 Jan 2026, reflecting intense selling pressure and panic among investors. The stock recorded a maximum daily loss of 4.97%, closing at ₹67.95, sharply underperforming its sector and broader market indices amid subdued liquidity and falling investor participation.

Read full news articleAre Cyber Media Research & Services Ltd latest results good or bad?

2026-01-24 19:14:03Cyber Media Research & Services Ltd's latest financial results for the third quarter of FY26 reveal a complex picture of performance. The company achieved its highest quarterly revenue of ₹22.29 crores, reflecting a sequential increase of 5.49% compared to the previous quarter. However, this revenue growth was overshadowed by a significant decline in net profit, which fell to ₹0.55 crores, marking a 33.73% decrease from the prior quarter. This sharp drop in profitability raises concerns about the company's operational efficiency and margin pressures. The operating margin saw a modest improvement, reaching 5.47%, up from 5.11%, indicating some operational discipline. However, the decline in net profit and the PAT margin, which dropped to 2.47%, suggest that the company is facing challenges in converting revenue growth into sustainable earnings. The gross profit margin also contracted, highlighting potential...

Read full news article

Cyber Media Research & Services Q3 FY26: Profitability Pressures Mount Despite Revenue Gains

2026-01-24 15:17:32Cyber Media Research & Services Limited reported a challenging third quarter for FY2026, with net profit declining 33.73% quarter-on-quarter to ₹0.55 crores despite a modest revenue uptick. The micro-cap IT research and consulting firm, with a market capitalisation of ₹21.00 crores, saw its profit after tax margin compress to 2.47% from 3.93% in the previous quarter, raising concerns about operational efficiency even as topline growth remained positive.

Read full news article

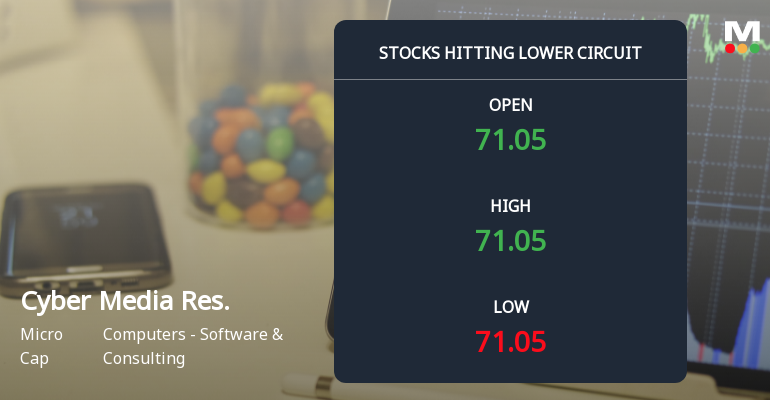

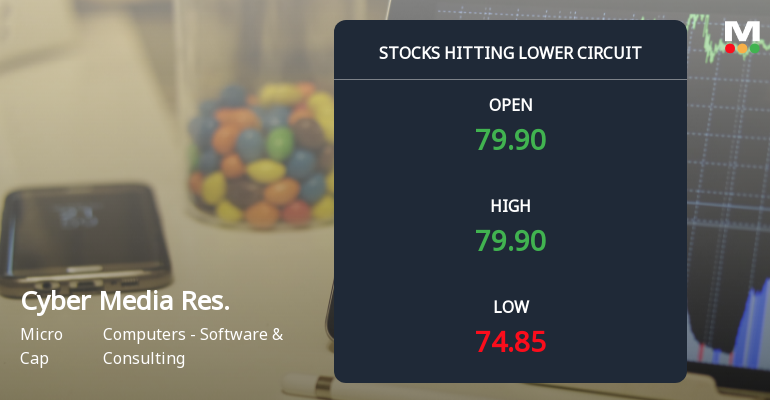

Cyber Media Research & Services Ltd Hits Lower Circuit Amid Heavy Selling Pressure

2026-01-14 15:00:08Shares of Cyber Media Research & Services Ltd tumbled sharply on 14 Jan 2026, hitting the lower circuit limit of ₹74.85, marking a maximum daily loss of 4.95%. The stock underperformed its sector and the broader market, reflecting intense selling pressure and panic among investors amid thin liquidity and unfilled supply.

Read full news article

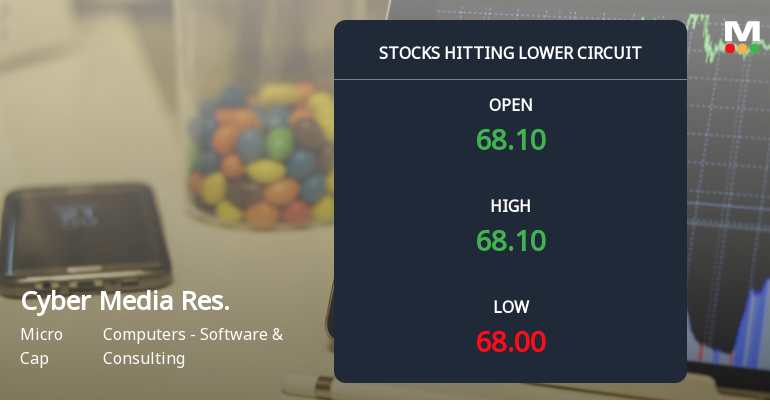

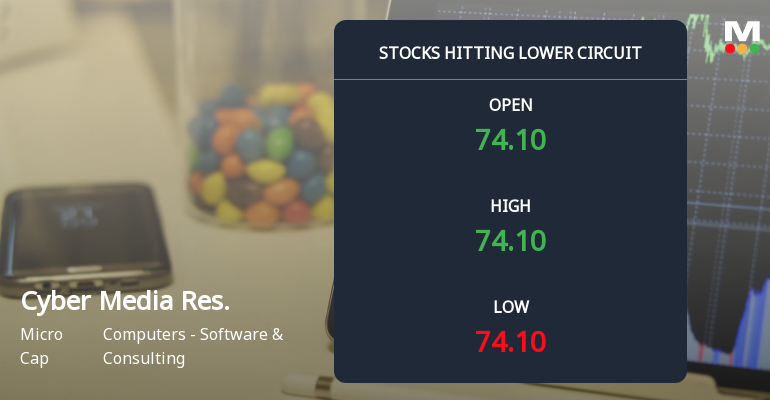

Cyber Media Research & Services Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

2026-01-05 10:00:50Shares of Cyber Media Research & Services Ltd plunged to their lower circuit limit on 5 January 2026, closing at ₹74.10 with a sharp decline of 4.94% in a single session. The stock faced intense selling pressure, reflecting mounting investor concerns amid deteriorating fundamentals and subdued market sentiment in the Computers - Software & Consulting sector.

Read full news article