Recent Price Movement and Market Context

DC Infotech & Communication Ltd’s stock price surged by Rs 8.70, or 3.79%, on 03-Feb, marking a significant intraday high of Rs 238.30. The stock opened with a gap up of 2.44%, signalling strong buying interest from the outset of trading. This price action is part of a broader short-term upward trend, with the stock having gained 6.38% over the past three consecutive days. Such a streak indicates growing investor confidence and positive sentiment surrounding the company’s prospects in the immediate term.

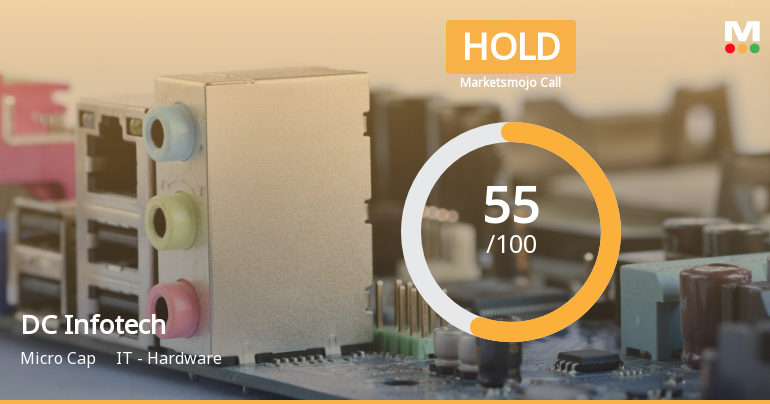

In comparison, the IT - Hardware sector, to which the company belongs, gained 2.07% on the same day. DC Infotech & Communication Ltd outperformed its sector by 1.68%, underscoring its relative strength within the industr...

Read full news article