Deere & Co. Experiences Revision in Stock Evaluation Amid Mixed Market Performance

2025-12-01 16:03:16Deere & Co. has recently revised its evaluation amid changing market conditions, with its stock priced at $464.49. The company has experienced a significant range in stock performance over the past year. Technical indicators show mixed trends, reflecting both challenges and opportunities in the current market landscape.

Read full news article

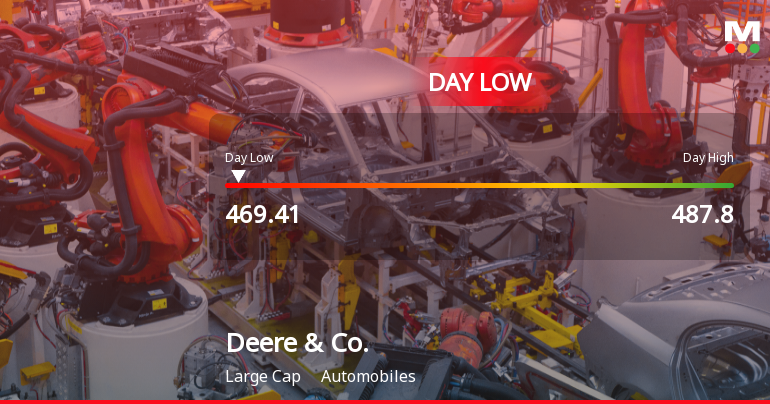

Deere & Co. Hits Day Low of $469.41 Amid Price Pressure

2025-11-27 16:40:02Deere & Co. faced a notable decline in stock performance, reflecting ongoing market challenges. Over the past week and month, the company's stock has underperformed compared to the S&P 500. Financial metrics reveal significant decreases in net sales and profit, highlighting the difficulties the company is currently experiencing.

Read full news article

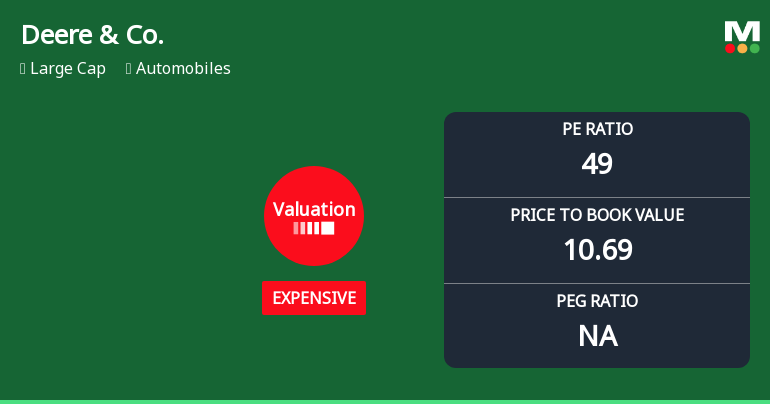

Deere & Co. Experiences Valuation Adjustment Amid Strong Market Position and Performance Metrics

2025-11-10 15:33:56Deere & Co. has recently adjusted its valuation metrics, reporting a P/E ratio of 49 and a price-to-book value of 10.69. The company maintains a solid return on capital employed of 12.69% and a return on equity of 21.95%, reflecting its competitive standing in the industry.

Read full news article