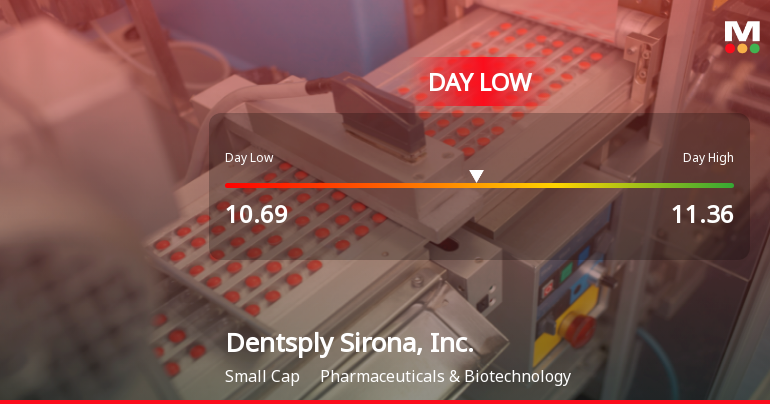

Dentsply Sirona Hits Day Low of $10.69 Amid Price Pressure

2025-11-07 16:41:16Dentsply Sirona, Inc. faced notable volatility, with its stock declining significantly today. The company has struggled with consistent underperformance over various timeframes, including a year-to-date loss of 41.94%. Despite some positive indicators, challenges such as low management efficiency and high institutional holdings contribute to a risky trading environment.

Read full news article

Dentsply Sirona Faces Weak Start with 9% Gap Down Amid Market Concerns

2025-11-07 16:25:43Dentsply Sirona, Inc. has experienced a significant decline in stock performance, with notable losses over the past day and month. Technical indicators suggest a bearish sentiment, while the company maintains a market capitalization of approximately USD 3.487 billion and a high dividend yield, despite a challenging financial environment.

Read full news article

Dentsply Sirona Hits 52-Week Low at $10.69 Amidst Significant Decline

2025-11-07 16:09:29Dentsply Sirona, Inc. has reached a new 52-week low, reflecting a substantial decline over the past year. The company, with a market capitalization of USD 3,487 million, faces profitability challenges despite a high dividend yield and positive operating profit margins. Its stock shows significant volatility and institutional ownership.

Read full news article