Key Events This Week

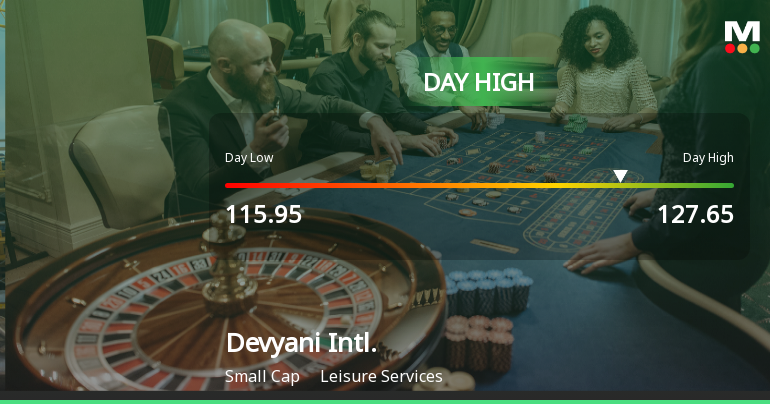

2 Feb: Stock opens at Rs.115.95 amid Sensex decline

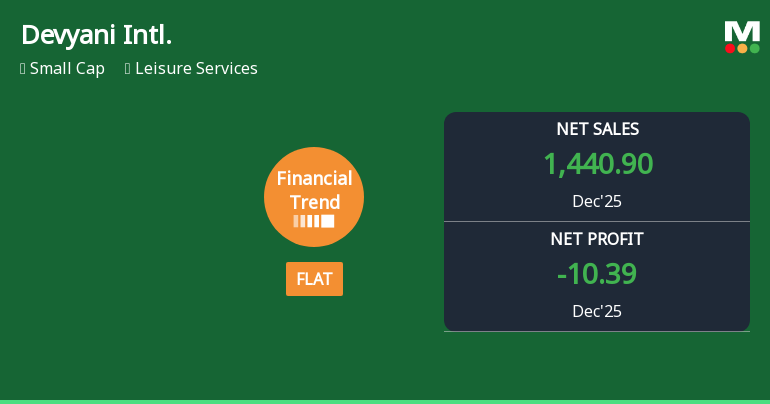

4 Feb: Intraday high of Rs.127.35 with 8.99% surge; flat quarterly results reported

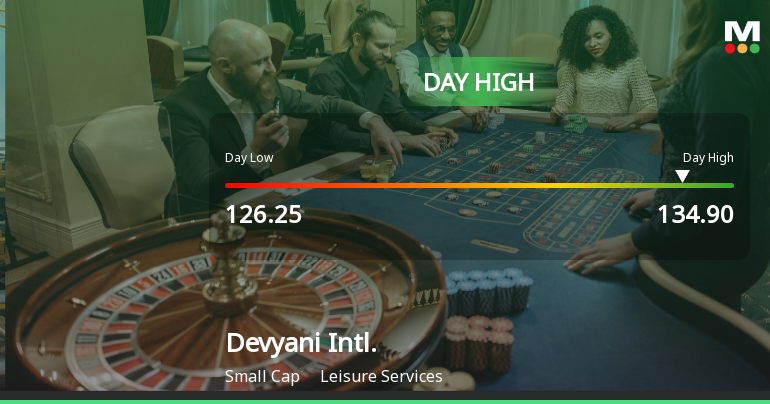

5 Feb: Intraday high of Rs.133.8 with 8.07% gain; exceptional volume surge and value trading

6 Feb: Week closes at Rs.130.35, down 1.21% on the day but up strongly for the week