Key Events This Week

16 Feb: Stock surges 8.83% to Rs.28.84 on upgrade announcement

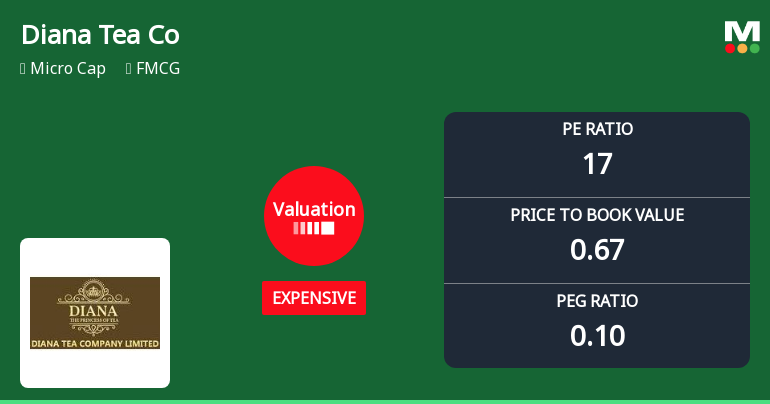

17 Feb: Rating upgraded to Sell with valuation shift noted

18 Feb: Price correction of 2.78% amid mixed technical signals

19 Feb: Further decline of 1.04% as Sensex dips 1.45%

20 Feb: Slight recovery to Rs.27.75 (+0.18%) closing the week