Recent Price Performance and Market Context

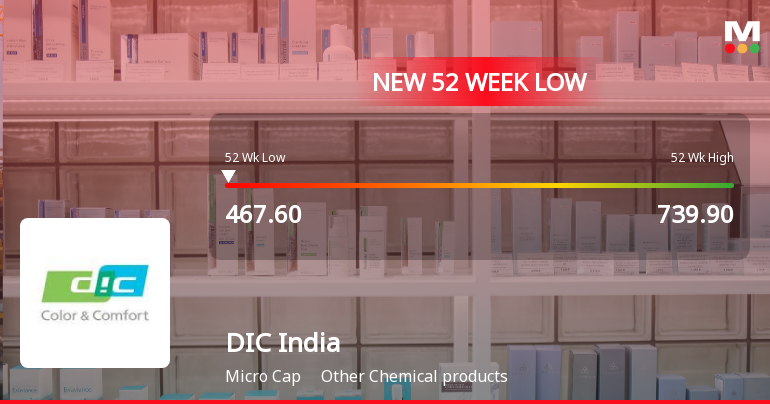

DIC India Ltd has been on a positive trajectory over the past month, delivering a 12.50% gain compared to the Sensex’s decline of 3.17% during the same period. Year-to-date, the stock has outperformed the benchmark by rising 12.68% while the Sensex fell 3.37%. This momentum is further underscored by an eight-day consecutive gain, during which the stock appreciated by 17.04%. Despite today's 2.46% rise, the stock slightly underperformed its sector, which gained 5.38% on the day.

The stock’s intraday high of ₹550 represented a 4.35% increase, signalling strong buying interest. However, the weighted average price suggests that a larger volume of shares traded closer to the day’s low, indicating some profit-taking or cautious tra...

Read full news article