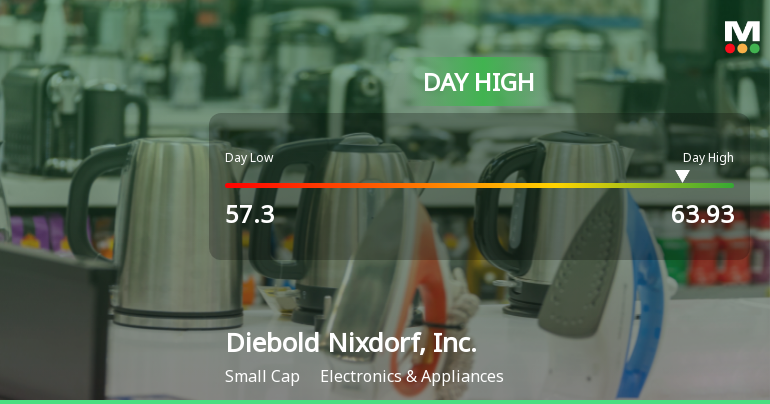

Diebold Nixdorf Hits Day High with 12.45% Surge Amid Market Decline

2025-11-06 16:08:05Diebold Nixdorf, Inc. has seen a notable rise in stock performance, significantly outperforming the S&P 500 over various time frames. The company boasts a market capitalization of USD 2,231 million, a low debt-to-equity ratio, and strong institutional backing, despite facing challenges in net sales growth and operating profit.

Read MoreIs Diebold Nixdorf, Inc. technically bullish or bearish?

2025-11-05 11:18:28As of 31 October 2025, the technical trend for Diebold Nixdorf, Inc. has changed from mildly bullish to bullish. The daily moving averages indicate a bullish stance, while the weekly MACD and KST are mildly bearish, suggesting some mixed signals in the shorter term. The Bollinger Bands show a mildly bullish trend on the monthly timeframe, and Dow Theory indicates a mildly bullish stance weekly but mildly bearish monthly. In terms of performance, Diebold Nixdorf has outperformed the S&P 500 year-to-date with a return of 30.67% compared to 16.30%, and over the past year, it has also slightly outperformed the benchmark with a return of 20.84% versus 19.89%. Overall, the current technical stance is bullish, albeit with some caution due to mixed indicators....

Read MoreIs Diebold Nixdorf, Inc. technically bullish or bearish?

2025-11-04 11:29:49As of 31 October 2025, the technical trend for Diebold Nixdorf, Inc. has changed from mildly bullish to bullish. The daily moving averages are bullish, and both the Bollinger Bands and Dow Theory indicate bullish conditions on the weekly and monthly time frames. However, the MACD and KST on the weekly are mildly bearish, suggesting some caution. The stock has outperformed the S&P 500 year-to-date with a return of 36.73% compared to 16.30%. Overall, the stance is bullish with moderate strength, driven by positive moving averages and Bollinger Bands....

Read MoreIs Diebold Nixdorf, Inc. technically bullish or bearish?

2025-11-03 11:28:50As of 31 October 2025, the technical trend for Diebold Nixdorf, Inc. has changed from mildly bullish to bullish. The current stance is bullish, supported by daily moving averages indicating a positive trend, and both weekly and monthly Bollinger Bands signaling bullish conditions. However, the MACD and KST on the weekly timeframe are mildly bearish, which suggests some caution. The Dow Theory indicates a mildly bullish stance on the weekly and bullish on the monthly, reinforcing the overall positive outlook. In terms of performance, Diebold Nixdorf has outperformed the S&P 500 with a year-to-date return of 37.43% compared to the S&P 500's 16.30%, and a one-year return of 27.81% versus 19.89%....

Read MoreIs Diebold Nixdorf, Inc. technically bullish or bearish?

2025-11-02 11:15:15As of 31 October 2025, the technical trend for Diebold Nixdorf, Inc. has changed from mildly bullish to bullish. The current stance is bullish, supported by daily moving averages indicating a bullish trend, and Bollinger Bands showing bullish signals on both weekly and monthly time frames. However, the MACD on a weekly basis is mildly bearish, which suggests some caution. The Dow Theory indicates a mildly bullish stance on the weekly and bullish on the monthly. In terms of performance, Diebold Nixdorf has outperformed the S&P 500 with a year-to-date return of 37.43% compared to the S&P 500's 16.30%, and a one-year return of 27.81% versus 19.89% for the benchmark....

Read More