Revenue and Profit Trends

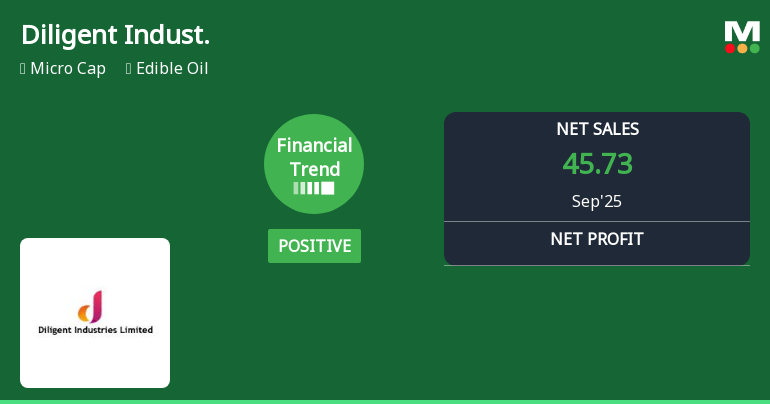

Over the past seven years, Diligent Indust. has seen its net sales rise from ₹77.85 crores in March 2019 to ₹143.56 crores in March 2025, reflecting a consistent upward trend. The total operating income mirrors this growth, with no other operating income reported during this period. Operating profit before depreciation, interest, and tax (PBDIT) excluding other income improved notably from ₹0.59 crores in 2019 to ₹7.65 crores in 2025, indicating enhanced operational efficiency. Including other income, operating profit rose to ₹7.67 crores in the latest fiscal year.

Profit after tax (PAT) also increased from ₹0.41 crores in 2019 to ₹2.52 crores in 2025, with the PAT margin improving from 0.53% to 1.76%. This steady rise in profitability undersc...

Read More