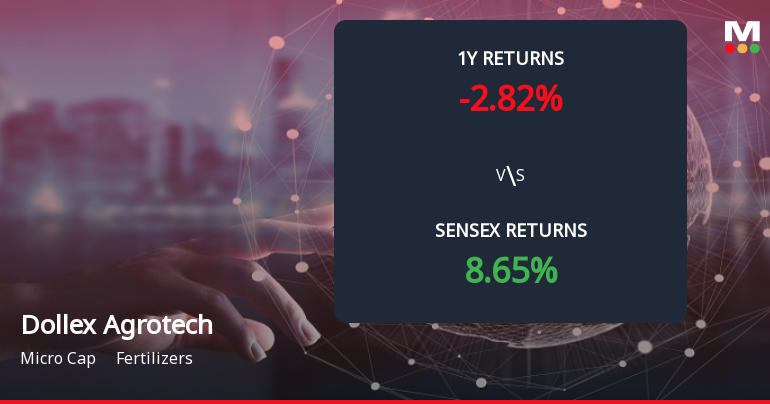

Recent Price Movement and Market Comparison

Dollex Agrotech’s share price has been under pressure over recent periods. In the past week, the stock fell by 4.89%, significantly lagging behind the Sensex’s modest decline of 0.52%. Over the last month, the stock’s loss widened to 7.45%, while the Sensex gained 0.79%. Year-to-date, Dollex Agrotech is down 0.79%, contrasting sharply with the Sensex’s robust 9.53% advance. The one-year performance further highlights the stock’s struggles, with a negative return of 6.99% against the Sensex’s 5.10% gain. This underperformance extends to longer horizons, where the stock has failed to keep pace with broader market indices such as the BSE500.

Technical Indicators and Trading Activity

On 11-Dec, Dollex Agro...

Read full news article