DoubleVerify Holdings Hits Day Low of $7.64 Amid Price Pressure

2025-11-10 17:55:37DoubleVerify Holdings, Inc. faced notable volatility on November 7, 2025, with a significant stock decline. The company has struggled over the past week and month, with year-to-date losses exceeding 51%. Financial metrics reveal challenges in profitability and valuation compared to industry peers, highlighting a tough market landscape.

Read full news article

DoubleVerify Holdings Hits 52-Week Low at $7.64 Amid Financial Struggles

2025-11-10 17:26:36DoubleVerify Holdings, Inc. has reached a new 52-week low, with a significant decline in stock price over the past year. The company reported a decrease in net profit despite increased interest, and its performance metrics indicate ongoing challenges compared to the broader market. It has not declared dividends and shows a negative debt-to-equity ratio.

Read full news article

DoubleVerify Holdings, Inc. Experiences Valuation Adjustment Amidst Market Pressures and Performance Challenges

2025-11-10 16:25:40DoubleVerify Holdings, Inc. has experienced a valuation adjustment, with its current price at $9.39, down from $10.97. Over the past year, the company has faced significant challenges, reflected in a -52.38% return. Key financial metrics include a P/E ratio of 46 and an EV to EBITDA of 17.21.

Read full news articleIs DoubleVerify Holdings, Inc. overvalued or undervalued?

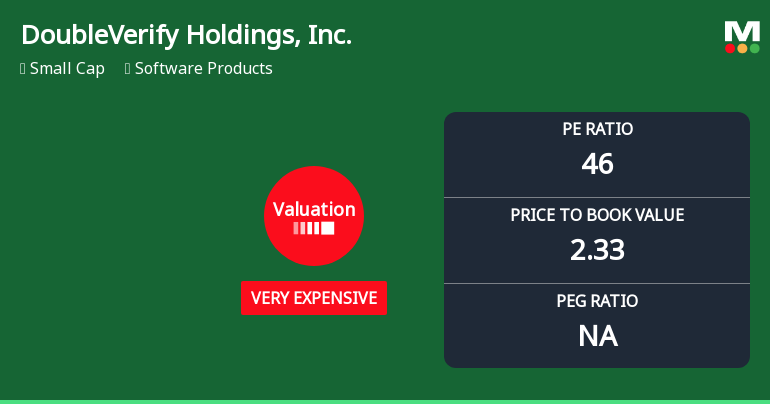

2025-11-10 11:16:29As of 7 November 2025, the valuation grade for DoubleVerify Holdings, Inc. has moved from very expensive to expensive, indicating a slight improvement in perceived value. The company appears to be overvalued based on its current metrics. The P/E ratio stands at 46, which is significantly higher than peers like Qualys, Inc. at 25.97 and Dolby Laboratories, Inc. at 25.89. Additionally, the EV to EBITDA ratio of 17.21 also suggests a premium compared to the industry, where the average for peers like ZoomInfo Technologies, Inc. is 14.59. In comparison to its peers, DoubleVerify's valuation metrics indicate that it is trading at a premium, with a Price to Book Value of 2.33 and an EV to Sales ratio of 3.30. This suggests that investors are paying more for each dollar of sales and book value compared to its competitors. Although the stock has not provided recent return data, it is essential to note that the valu...

Read full news articleIs DoubleVerify Holdings, Inc. overvalued or undervalued?

2025-11-09 11:09:59As of 7 November 2025, the valuation grade for DoubleVerify Holdings, Inc. has moved from very expensive to expensive, indicating a slight improvement but still suggesting overvaluation. The company appears overvalued based on its current metrics, with a P/E ratio of 46, a Price to Book Value of 2.33, and an EV to EBITDA of 17.21. In comparison, Duolingo, Inc. has a significantly higher P/E ratio of 104.90, while Qualys, Inc. presents a more attractive P/E of 25.97. The stock has underperformed relative to the S&P 500, with a year-to-date return of -51.12% compared to the index's gain of 14.40%. This stark contrast reinforces the notion that DoubleVerify Holdings, Inc. is currently overvalued in the market....

Read full news article