Dycom Industries, Inc. Reports Strong Financial Performance in Latest Quarter

2025-11-25 15:33:28Dycom Industries, Inc., a small-cap company in the construction sector, has reported impressive financial results for the quarter ending July 2025. The company has demonstrated significant growth across various financial metrics, indicating a robust operational performance.

One of the standout figures from the latest results is the operating cash flow, which reached its highest level at USD 397.48 MM. This strong cash flow position is a positive indicator of the company's ability to generate liquidity from its operations.

Additionally, the interest coverage ratio has also hit a record high of 1,290.01, showcasing the company's strong ability to meet its interest obligations. This metric reflects the financial health of Dycom Industries, Inc. and its capacity to manage debt effectively.

In terms of cost management, the company has successfully redu...

Read full news article

Dycom Industries Hits New 52-Week High of $350.87, Up 79.56%

2025-11-21 15:42:16Dycom Industries, Inc. achieved a new 52-week high of USD 350.87 on November 20, 2025, reflecting strong performance in the construction sector with a one-year gain of 79.56%. The company has a market cap of USD 7,311 million and a P/E ratio of 30.00, with a return on equity of 19.05%.

Read full news article

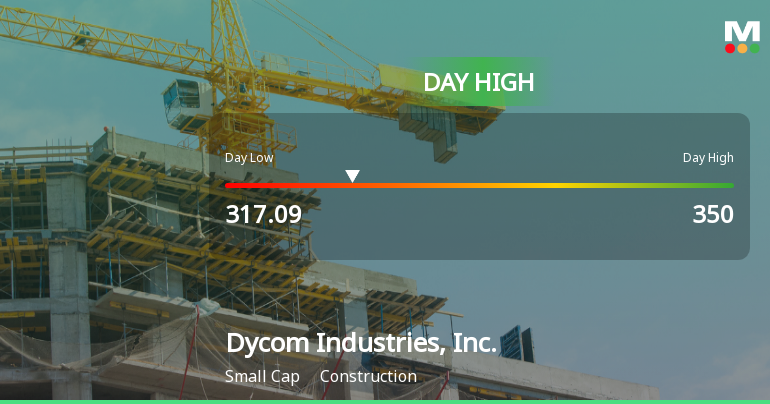

Dycom Industries Hits Day High with Strong 9.82% Intraday Surge

2025-11-20 16:52:33Dycom Industries, Inc. has shown impressive stock performance, significantly outperforming the S&P 500 over various time frames. The company boasts strong long-term growth, highlighted by a notable operating profit growth rate and robust operational efficiency metrics, alongside high institutional ownership, reinforcing its competitive position in the construction industry.

Read full news article

Dycom Industries Reaches New 52-Week High of $350.00

2025-11-20 16:22:56Dycom Industries, Inc. achieved a new 52-week high of USD 350.00 on November 19, 2025, reflecting its strong performance in the construction industry with an impressive one-year growth of 80.63%. The company, with a market cap of USD 7,311 million, demonstrates effective capital management and profitability.

Read full news article