Key Events This Week

5 Jan: Stock opens at ₹1,007.85, marginally down 0.14%

6 Jan: Continued decline to ₹997.95 amid broader market weakness

8 Jan: Downgrade to Sell rating by MarketsMOJO announced

9 Jan: Technical momentum shift confirmed with a 3.48% drop to ₹960.40

Why is EID Parry (India) Ltd falling/rising?

2026-01-10 01:10:30

Short-Term Price Performance and Market Sentiment

On 09-Jan, EID Parry’s shares closed lower by ₹21, marking a 2.19% drop. This decline is part of a broader trend, with the stock losing 6.92% over the past week and 7.10% in the last month, significantly underperforming the Sensex benchmark, which fell 2.55% and 1.29% respectively over the same periods. Year-to-date, the stock has declined 9.27%, compared to a more modest 1.93% fall in the Sensex.

The stock has been on a consecutive seven-day losing streak, reflecting a weakening investor sentiment. Intraday, the share price touched a low of ₹935, down 2.64% from previous levels. Technical indicators also point to bearish momentum, with the stock trading below all key moving averages – 5-day, 20-day, 50-day, 100-day, an...

Read full news article

EID Parry Downgraded to Sell Amid Technical Weakness and Valuation Concerns

2026-01-09 08:05:16EID Parry (India) Ltd, a leading player in the fertilisers sector, has seen its investment rating downgraded from Hold to Sell as of 8 January 2026. This shift reflects a combination of deteriorating technical indicators, expensive valuation metrics, and a cautious outlook on financial trends despite recent positive quarterly results. The downgrade underscores growing investor concerns amid a mildly bearish technical environment and stretched price multiples relative to peers.

Read full news article

EID Parry (India) Ltd Faces Technical Momentum Shift Amid Bearish Signals

2026-01-09 08:01:17EID Parry (India) Ltd has experienced a notable shift in its technical momentum, moving from a mildly bullish to a mildly bearish trend as of early January 2026. This change is underscored by a combination of bearish signals across key technical indicators including MACD, KST, and Bollinger Bands, alongside a significant drop in the stock price, reflecting growing investor caution in the fertiliser sector.

Read full news article

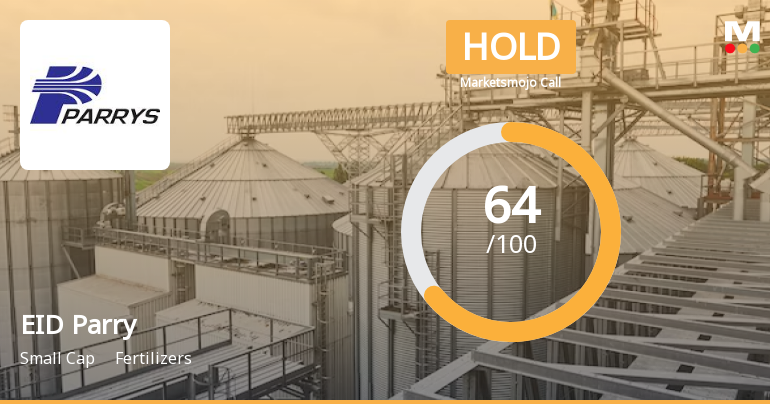

EID Parry (India) Ltd is Rated Hold by MarketsMOJO

2025-12-29 10:10:52EID Parry (India) Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 01 Sep 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 December 2025, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

EID Parry's Evaluation Metrics Revised Amid Sector Dynamics and Financial Trends

2025-12-18 10:10:41EID Parry's recent assessment has undergone a revision reflecting changes across key evaluation parameters including quality, valuation, financial trends, and technical outlook. This shift comes amid evolving sector conditions and the company's latest financial disclosures, offering investors a nuanced perspective on its market position within the fertilisers sector.

Read full news article