Key Events This Week

Feb 9: Q2 FY26 results reveal seasonal weakness with profits down 33%

Feb 9: Technical upgrade from Strong Sell to Sell on improved indicators

Feb 10: Strong quarterly turnaround reported with margin expansion

Feb 12: Technical momentum shifts to bearish amid price decline

Feb 13: Week closes at Rs.337.65, down 5.53%

EIH Associated Hotels Ltd Technical Momentum Shifts Amid Bearish Signals

2026-02-12 08:03:19EIH Associated Hotels Ltd has experienced a notable shift in its technical momentum, with key indicators signalling a bearish trend. Despite a strong long-term performance relative to the Sensex, recent price action and technical parameters suggest caution for investors as the stock faces downward pressure amid weakening momentum.

Read full news article

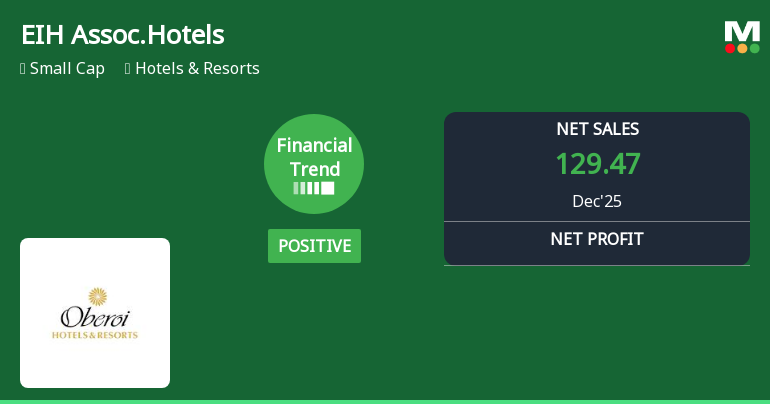

EIH Associated Hotels Ltd Reports Strong Quarterly Turnaround Amid Margin Expansion

2026-02-10 08:00:22EIH Associated Hotels Ltd has demonstrated a marked improvement in its financial performance for the quarter ended December 2025, reversing a previously negative trend. The company’s latest results reveal robust revenue growth, significant margin expansion, and improved operational efficiency, signalling a potential inflection point for investors in the Hotels & Resorts sector.

Read full news articleAre EIH Associated Hotels Ltd latest results good or bad?

2026-02-09 19:17:54EIH Associated Hotels Ltd's latest financial results for Q2 FY26 reflect significant operational challenges primarily due to the seasonal nature of the hospitality industry. The company reported a net profit of ₹2.77 crore, which represents a notable decline of 55.17% quarter-on-quarter, although it shows a year-on-year increase of 33.17%. This juxtaposition highlights the impact of seasonal demand fluctuations, particularly during the monsoon period, which is traditionally a lean season for leisure-focused properties. Revenue for the quarter stood at ₹58.33 crore, reflecting a decrease of 15.14% compared to the previous quarter and a 17.66% decline year-on-year. This decline is attributed to both seasonal headwinds and broader challenges within the Indian hospitality sector, including heightened competition and moderating domestic travel demand. The operating margin, excluding other income, fell to 4.59%,...

Read full news article

EIH Associated Hotels Q3 FY26: Seasonal Strength Masks Underlying Weakness

2026-02-09 18:02:09EIH Associated Hotels Ltd., operator of premium Oberoi and Trident properties across India, reported net profit of ₹40.59 crores for Q3 FY26, registering sequential growth of 1,365.34% quarter-on-quarter but declining 1.72% year-on-year. The ₹2,070-crore market capitalisation company's results reflect strong seasonal tailwinds typical of the winter tourism quarter, yet underlying trends reveal persistent challenges that have weighed on investor sentiment.

Read full news article

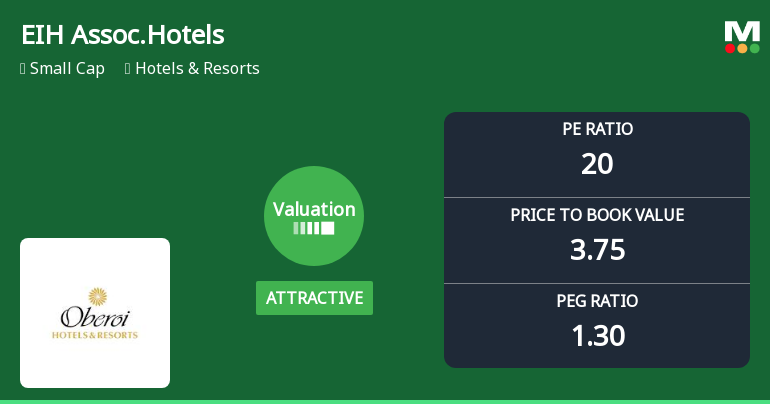

EIH Associated Hotels Ltd Upgraded to Sell on Technical Improvements Despite Financial Challenges

2026-02-09 08:17:51EIH Associated Hotels Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 6 February 2026, driven primarily by a shift in technical indicators despite ongoing financial headwinds. The company’s technical grade improved from bearish to mildly bearish, reflecting a cautious optimism in market sentiment. However, fundamental challenges remain, including negative quarterly financial results and underperformance relative to the broader market over the past year.

Read full news article