Key Events This Week

2 Feb: Modest gain of 0.29% despite Sensex decline

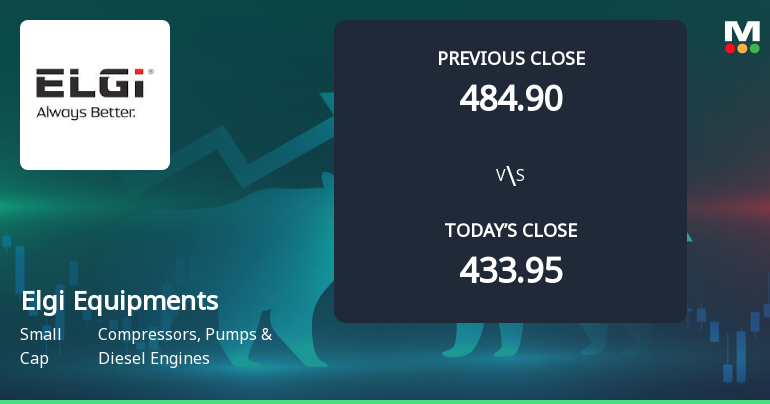

3 Feb: Intraday high of Rs.483.35 with 10.1% surge and gap-up opening

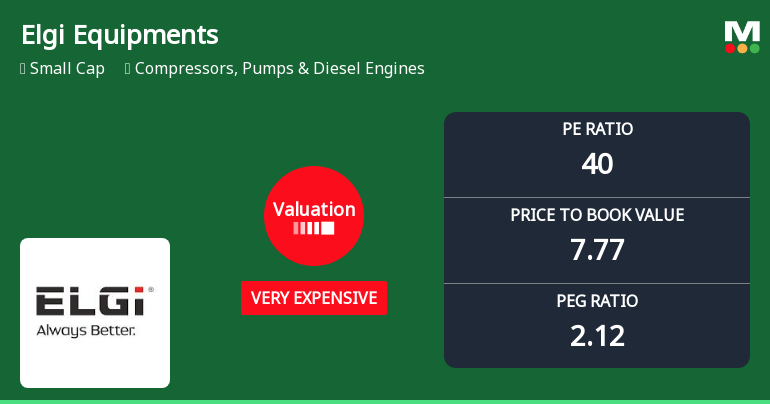

4 Feb: Technical momentum shift amid mixed signals; valuation turns very expensive

5-6 Feb: Minor pullbacks with subdued volume; week closes at Rs.485.80

Elgi Equipments Ltd is Rated Hold

2026-02-07 10:10:48Elgi Equipments Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 07 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Elgi Equipments Ltd Sees Technical Momentum Shift Amid Mixed Market Signals

2026-02-04 08:03:00Elgi Equipments Ltd has experienced a notable shift in its technical momentum, reflected in a significant price surge and evolving indicator signals. While some technical parameters suggest cautious optimism, others maintain a bearish undertone, presenting a complex picture for investors navigating the compressors and pumps sector.

Read full news article

Elgi Equipments Ltd Valuation Shifts Signal Heightened Price Premium

2026-02-04 08:01:24Elgi Equipments Ltd has witnessed a significant shift in its valuation parameters, moving from an expensive to a very expensive rating. This article analyses the recent changes in key valuation metrics such as price-to-earnings (P/E) and price-to-book value (P/BV) ratios, comparing them with historical averages and peer benchmarks to assess the stock’s price attractiveness amid evolving market dynamics.

Read full news articleWhy is Elgi Equipments Ltd falling/rising?

2026-02-04 01:12:56

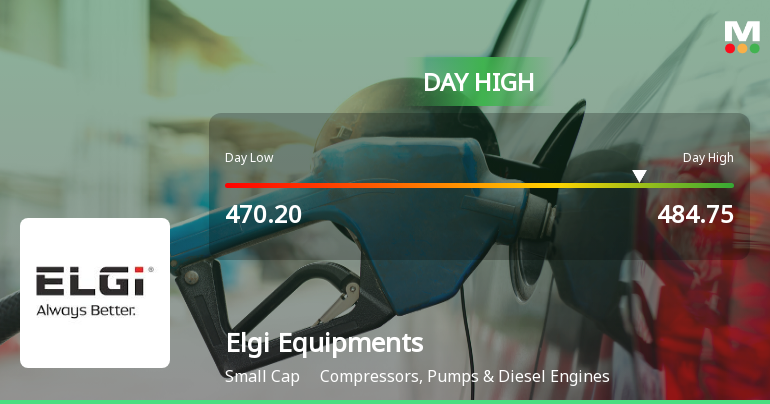

Strong Daily Performance Reflects Sector Momentum

Elgi Equipments Ltd outperformed its sector peers and the broader market on 03-Feb, registering a remarkable intraday high of ₹495.6, representing a 14.21% increase. The stock opened with a gap up of 10.45%, signalling strong buying interest from the outset. This surge was notably ahead of the compressors and pumps sector, which itself gained 6.24% on the day, underscoring the positive sentiment surrounding the industry. The stock’s performance also eclipsed the sector by 7.14%, highlighting its relative strength within the segment.

Despite the strong price appreciation, the weighted average price indicated that more volume was traded near the lower end of the day’s price range, suggesting some profit-taking or cautious...

Read full news article

Elgi Equipments Ltd Opens Strong with Significant Gap Up on 3 Feb 2026

2026-02-03 09:44:05Elgi Equipments Ltd commenced trading with a significant gap up, opening 10.45% higher than its previous close, signalling robust positive sentiment in the compressors and pumps sector. This strong start was accompanied by an intraday high surge of 11.38%, outperforming both its sector and the broader market indices.

Read full news article

Elgi Equipments Ltd Hits Intraday High with 10.1% Surge on 3 Feb 2026

2026-02-03 09:37:05Elgi Equipments Ltd demonstrated robust intraday performance on 3 Feb 2026, surging to an intraday high of Rs 483.35, marking an 11.38% increase from its previous close. The stock outpaced its sector and broader market indices, reflecting significant trading momentum in the Compressors, Pumps & Diesel Engines industry.

Read full news article

Elgi Equipments Ltd is Rated Hold

2026-01-27 10:10:49Elgi Equipments Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

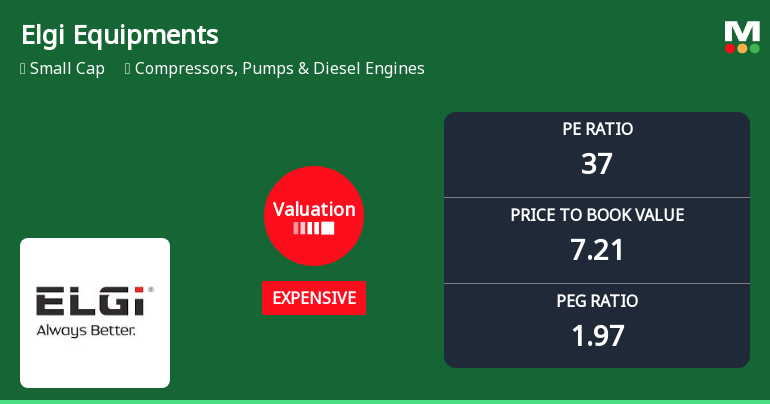

Elgi Equipments Ltd Valuation Shifts Signal Changing Price Attractiveness

2026-01-09 08:00:26Elgi Equipments Ltd has experienced a notable shift in its valuation parameters, moving from a 'very expensive' to an 'expensive' rating, reflecting a subtle but meaningful change in price attractiveness. This article analyses the recent valuation metrics, compares them with historical and peer averages, and assesses the implications for investors amid a challenging market backdrop.

Read full news article