Is EMCOR Group, Inc. overvalued or undervalued?

2025-11-05 11:09:51As of 31 October 2025, the valuation grade for EMCOR Group, Inc. has moved from attractive to fair. Based on the current metrics, the company appears to be fairly valued. The P/E ratio stands at 24, while the EV to EBITDA ratio is 16.28, and the PEG ratio is notably low at 0.48, indicating potential for growth relative to its price. In comparison to peers, Comfort Systems USA, Inc. has a higher P/E ratio of 38.72, while AECOM is valued at 22.09, suggesting that EMCOR Group is positioned competitively within the industry. Despite its fair valuation, EMCOR has demonstrated strong performance, with a year-to-date return of 44.19%, significantly outpacing the S&P 500's return of 16.30% over the same period....

Read full news articleIs EMCOR Group, Inc. overvalued or undervalued?

2025-11-04 11:15:48As of 31 October 2025, the valuation grade for EMCOR Group, Inc. has moved from attractive to fair, indicating a shift in its perceived value. The company appears to be fairly valued at this time. Key valuation ratios include a P/E ratio of 24, an EV to EBITDA of 16.28, and a PEG ratio of 0.48, which suggests that the stock may be priced reasonably given its growth prospects. In comparison to its peers, Comfort Systems USA, Inc. has a higher P/E of 38.72 and an EV to EBITDA of 26.63, while AECOM is considered expensive with a P/E of 22.09. This positions EMCOR favorably within its industry, as it maintains competitive ratios despite the recent downgrade in valuation grade. Notably, while EMCOR's stock has returned 48.61% over the past year, outperforming the S&P 500's 19.89%, the recent one-week decline of 10.77% contrasts sharply with the broader market's positive performance....

Read full news articleIs EMCOR Group, Inc. overvalued or undervalued?

2025-11-03 11:14:54As of 31 October 2025, EMCOR Group, Inc. has moved from an attractive to a fair valuation grade. The company appears to be fairly valued based on its current metrics. Key ratios include a P/E ratio of 24, an EV to EBITDA ratio of 16.28, and a PEG ratio of 0.48, which suggests strong growth potential relative to its price. In comparison, Comfort Systems USA, Inc. has a higher P/E of 38.72, while AECOM is considered expensive with a P/E of 22.09. Despite the recent dip in stock price, EMCOR has outperformed the S&P 500 significantly over the longer term, with a 3-year return of 378.94% compared to the S&P 500's 76.66%. This strong historical performance, combined with its solid financial ratios, indicates that the company is fairly valued in the current market context....

Read full news articleIs EMCOR Group, Inc. overvalued or undervalued?

2025-11-02 11:08:21As of 31 October 2025, the valuation grade for EMCOR Group, Inc. moved from attractive to fair. The company appears to be fairly valued based on its current metrics. Key ratios include a P/E ratio of 24, a Price to Book Value of 8.63, and an EV to EBITDA of 16.28. In comparison, Comfort Systems USA, Inc. has a higher P/E ratio of 38.72, while AECOM is considered expensive with a P/E of 22.09. Despite the recent downgrade in valuation, EMCOR has shown impressive returns, outperforming the S&P 500 over multiple periods, including a YTD return of 48.88% compared to the S&P 500's 16.30%. This strong performance suggests that while the stock is currently fairly valued, it has the potential for continued growth....

Read full news article

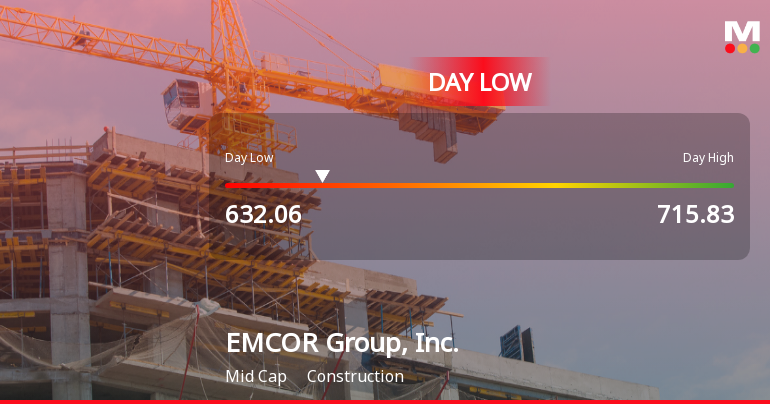

EMCOR Group Stock Hits Day Low of $632.06 Amid Price Pressure

2025-10-31 16:52:51EMCOR Group, Inc. saw a notable stock decline today, reaching an intraday low. However, the company has demonstrated strong annual performance, significantly outperforming the S&P 500. With robust fundamentals, high institutional ownership, and consistent positive results over recent quarters, EMCOR remains a strong player in the construction industry.

Read full news article

EMCOR Group Faces Weak Start with 14.41% Gap Down Amid Market Concerns

2025-10-31 16:36:49EMCOR Group, Inc. experienced a notable decline today, contrasting with the stable performance of the S&P 500. Despite this, the company has a strong market capitalization of approximately USD 32.4 billion, a price-to-earnings ratio of 24.00, and a dividend yield of 7.35%, indicating financial strength and shareholder value.

Read full news article

EMCOR Group Hits Day High with 7.46% Surge in Strong Intraday Performance

2025-10-27 17:31:14EMCOR Group, Inc. has experienced notable stock performance, achieving significant growth over various timeframes, including a year-to-date increase of 64.85%. The company has reported positive results for seven consecutive quarters, demonstrating strong fundamentals and high institutional holdings, reinforcing its position in the construction industry.

Read full news article

EMCOR Group Opens with 4.84% Gain, Outperforming S&P 500's 0.79% Rise

2025-10-27 17:10:05EMCOR Group, Inc. has shown strong market performance, significantly outperforming the S&P 500 over various time frames. The company maintains robust fundamentals, including a high Return on Equity and consistent positive results over seven quarters. Its low debt-to-equity ratio and high institutional holdings reflect a solid financial position.

Read full news article

EMCOR Group Hits New 52-Week High of $752.52, Up 97.41%

2025-10-27 16:38:03EMCOR Group, Inc. has achieved a new 52-week high, reflecting its strong performance with a one-year return significantly exceeding the S&P 500. The company boasts a market capitalization of USD 32,383 million, impressive financial metrics, consistent growth in net sales and operating profit, and high institutional holdings.

Read full news article