Is Equinix, Inc. technically bullish or bearish?

2025-11-05 11:19:59As of 31 October 2025, the technical trend for Equinix, Inc. has changed from mildly bearish to mildly bullish. The weekly MACD and KST are both indicating a mildly bullish stance, while the monthly MACD and KST remain mildly bearish. The Bollinger Bands show a mildly bullish trend on the weekly chart but bearish on the monthly. Daily moving averages are mildly bearish, which contrasts with the overall weekly indicators. There is no trend indicated by Dow Theory or OBV in either time frame. In terms of performance, Equinix has underperformed the S&P 500 year-to-date, with a return of -11.98% compared to the S&P's 16.30%, and over the past year, it has returned -6.57% versus the S&P's 19.89%. However, over the past three years, it has shown a positive return of 41.78%, although this is still below the S&P's 76.66%. Overall, the current stance is mildly bullish, but the mixed signals across different indicat...

Read full news articleIs Equinix, Inc. technically bullish or bearish?

2025-11-04 11:31:28As of 31 October 2025, the technical trend for Equinix, Inc. has changed from mildly bearish to mildly bullish. The weekly MACD and KST indicators are both mildly bullish, while the monthly MACD and KST remain mildly bearish, indicating mixed signals across time frames. The weekly Bollinger Bands also suggest a mildly bullish stance, contrasting with the monthly bearish outlook. Daily moving averages are mildly bearish, adding some caution to the overall assessment. In terms of performance, Equinix has underperformed the S&P 500 across most periods, with a year-to-date return of -11.67% compared to the S&P 500's 16.30%, and a one-year return of -6.24% versus 19.89%. However, over the three-year period, Equinix shows a return of 42.28%, which is significantly lower than the S&P 500's 76.66%. Overall, the current technical stance is mildly bullish, but the mixed signals and underperformance relative to the ...

Read full news articleIs Equinix, Inc. technically bullish or bearish?

2025-11-03 11:30:31As of 31 October 2025, the technical trend for Equinix, Inc. has changed from mildly bearish to mildly bullish. The weekly MACD is mildly bullish, supported by bullish signals from the Bollinger Bands and Dow Theory, while the daily moving averages indicate a mildly bearish stance. The KST shows a mildly bullish trend on the weekly basis, and the OBV is also mildly bullish. In terms of performance, Equinix has outperformed the S&P 500 over the past week and month, with returns of 0.78% and 9.31% respectively, but has underperformed over the year-to-date and one-year periods. Overall, the current technical stance is mildly bullish, driven by positive weekly indicators despite some mixed signals on longer time frames....

Read full news articleIs Equinix, Inc. technically bullish or bearish?

2025-11-02 11:16:26As of 31 October 2025, the technical trend for Equinix, Inc. has changed from mildly bearish to mildly bullish. The weekly MACD is mildly bullish, supported by bullish signals from the Bollinger Bands and the Dow Theory, both on a weekly basis. However, the monthly MACD and KST remain mildly bearish, indicating some caution. The daily moving averages are mildly bearish, which contrasts with the overall weekly indicators. In terms of performance, Equinix has outperformed the S&P 500 over the past week and month, returning 0.78% and 9.31% respectively, while the S&P 500 returned 0.71% and 1.92%. However, the year-to-date and one-year returns are negative at -10.27% and -6.84%, significantly lagging behind the S&P 500's gains of 16.30% and 19.89%. Overall, the current stance is mildly bullish, driven primarily by weekly indicators, but caution is warranted due to mixed signals on longer time frames....

Read full news article

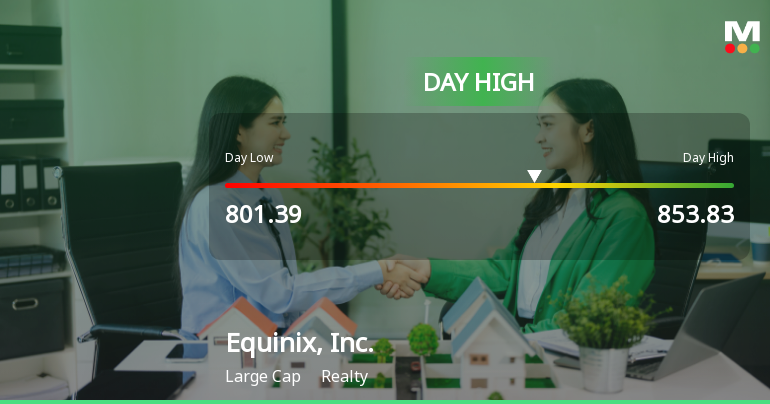

Equinix Stock Soars to Intraday High of $853.83 Amid Strong Performance

2025-10-31 17:01:49Equinix, Inc. has shown notable activity, gaining 4.44% on October 30, 2025, with an intraday high of USD 853.83. The company has a market capitalization of USD 75,148 million and high institutional holdings. Despite recent fluctuations, it continues to be a significant player in the realty sector.

Read full news article

Equinix, Inc. Experiences Revision in Stock Evaluation Amid Market Dynamics

2025-10-28 15:14:37Equinix, Inc. has recently revised its evaluation amid changing market conditions. The stock is currently priced at $842.77, reflecting a notable range in its 52-week performance. While it has outperformed the S&P 500 over the past week, its year-to-date performance shows underwhelming returns compared to the index.

Read full news articleIs Equinix, Inc. technically bullish or bearish?

2025-10-28 11:40:30As of 24 October 2025, the technical trend for Equinix, Inc. has changed from mildly bearish to sideways. The current stance is neutral, with mixed signals across different time frames. The weekly MACD is mildly bullish, while the monthly MACD is mildly bearish. The Bollinger Bands indicate a bullish weekly trend but a sideways monthly trend. Moving averages are mildly bearish on the daily timeframe. Dow Theory shows a mildly bullish stance on both weekly and monthly periods. In terms of performance, Equinix has outperformed the S&P 500 over the past week and month, returning 3.14% and 6.29% respectively, but it lags behind the benchmark on a year-to-date and one-year basis, with returns of -10.97% and -6.28%. Overall, the mixed indicators suggest a cautious approach....

Read full news articleIs Equinix, Inc. technically bullish or bearish?

2025-10-27 11:51:38As of 24 October 2025, the technical trend for Equinix, Inc. has changed from mildly bearish to sideways. The current stance is neutral, with mixed indicators across different time frames. The weekly MACD is mildly bullish, while the monthly MACD is mildly bearish. The weekly Bollinger Bands indicate a bullish trend, but the daily moving averages are mildly bearish. The KST and OBV are both mildly bullish on a weekly basis, suggesting some positive momentum. In terms of performance, Equinix has outperformed the S&P 500 over the past week and month, with returns of 3.14% and 6.29% compared to the S&P 500's 1.92% and 2.32%, respectively. However, the year-to-date and one-year returns are negative at -10.97% and -6.28%, significantly lagging behind the S&P 500's gains. Overall, the mixed signals indicate a cautious outlook....

Read full news article