Key Events This Week

2 Feb: Stock plunges 4.89% amid broad market weakness

3 Feb: Recovery begins with 1.46% gain as Sensex rallies

5 Feb: Q3 FY26 results reveal profit plunge; mixed technical signals emerge

6 Feb: Week closes at Rs.341.85, down slightly from prior day

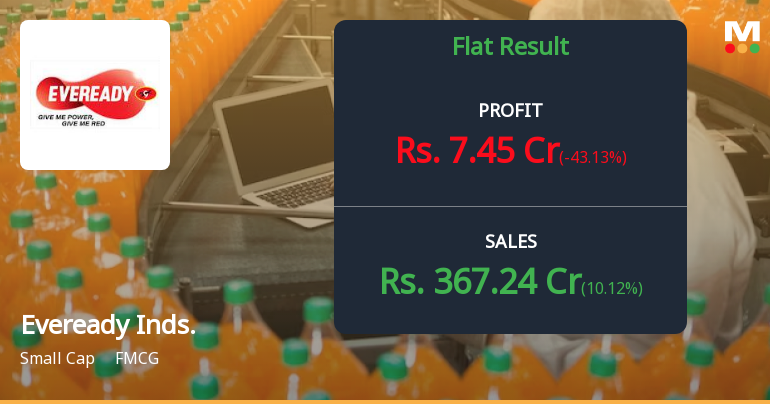

Are Eveready Industries India Ltd latest results good or bad?

2026-02-06 19:21:30Eveready Industries India Ltd's latest financial results for Q3 FY26 present a complex picture of operational performance. The company reported net sales of ₹367.24 crores, reflecting a year-on-year growth of 10.12% compared to ₹333.50 crores in the same quarter last year. This indicates the company's ability to generate revenue growth amidst a challenging market environment. However, the net profit for the quarter was ₹7.45 crores, which represents a significant decline of 43.13% compared to the previous year. This sharp drop in profitability raises concerns about the company's ability to convert revenue growth into profit. The profit after tax (PAT) margin fell to 2.03%, down from 3.93% in the corresponding quarter of the previous year, highlighting issues with earnings quality. The operating margin stood at 8.98%, which is a slight improvement from 8.76% year-on-year but shows a noticeable decline from...

Read full news articleWhy is Eveready Industries India Ltd falling/rising?

2026-02-06 00:53:28

Recent Price Performance and Market Comparison

Eveready Industries has outperformed the broader market and its sector peers in the short term. Over the past week, the stock gained 3.80%, significantly ahead of the Sensex’s 0.91% rise. Similarly, the one-month and year-to-date returns stand positive at 3.03% and 4.02% respectively, contrasting with the Sensex’s declines of 2.49% and 2.24% over the same periods. This recent momentum is further underscored by a three-day consecutive gain, during which the stock appreciated by 7.42%. Intraday, the share price touched a high of ₹356.05, marking a 7.8% increase from previous levels.

However, the longer-term picture is less encouraging. Over the past year, Eveready’s stock has declined by 1.73%, underperforming the Sensex’s 6...

Read full news article

Eveready Industries Q3 FY26: Profit Plunge Dims Battery Maker's Prospects

2026-02-05 19:31:28Eveready Industries India Limited, the iconic battery and flashlight manufacturer with a market capitalisation of ₹2,527 crores, posted a disappointing performance in Q3 FY26, with net profit plummeting 43.13% year-on-year to ₹7.45 crores. The results, which also showed a sequential decline of 194.18% from Q2 FY26's loss of ₹7.91 crores, have raised concerns about the company's ability to sustain profitability amidst mounting operational pressures. The stock reacted with volatility, trading at ₹342.90 on February 05, 2026, reflecting a modest gain of 3.81% from the previous close, though it remains 27.84% below its 52-week high of ₹475.20.

Read full news article

Eveready Industries India Ltd Sees Mixed Technical Signals Amid Mild Momentum Shift

2026-02-05 08:01:50Eveready Industries India Ltd has experienced a nuanced shift in its technical momentum, moving from a bearish stance to a mildly bearish outlook. Despite a recent uptick in price, key technical indicators present a complex picture, reflecting both cautious optimism and lingering bearish pressures within the FMCG sector.

Read full news article

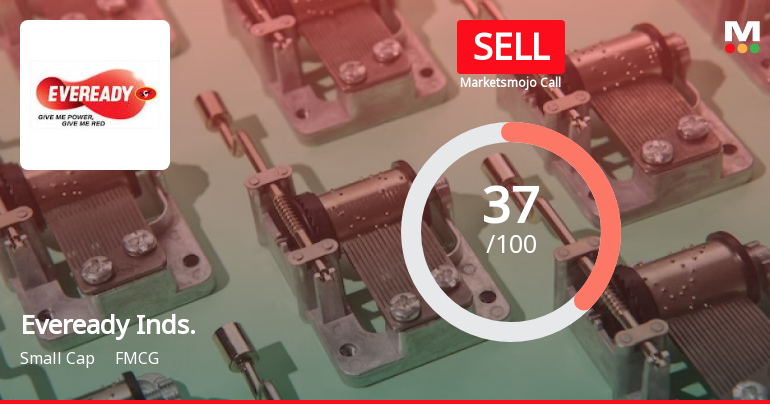

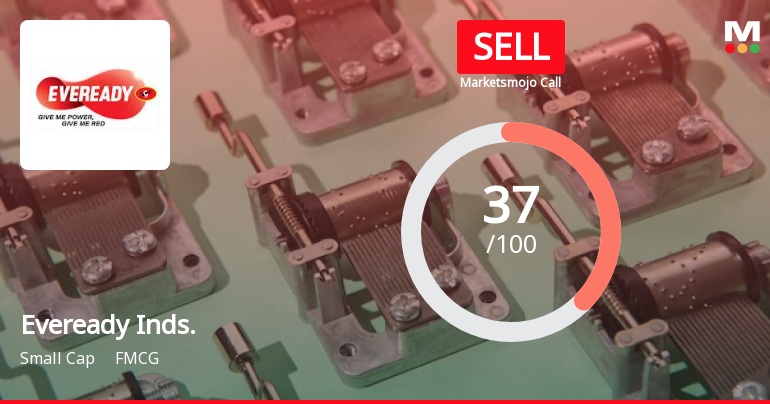

Eveready Industries India Ltd is Rated Sell

2026-02-02 10:10:04Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 06 Nov 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 02 February 2026, providing investors with the latest perspective on the company’s position.

Read full news article

Eveready Industries India Ltd is Rated Sell

2026-01-22 10:10:04Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 06 Nov 2025, but the analysis below reflects the stock's current position as of 22 January 2026, incorporating the latest fundamentals, returns, and financial metrics.

Read full news article

Eveready Industries India Ltd is Rated Sell

2026-01-11 10:10:03Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 11 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Eveready Industries India Ltd is Rated Sell

2025-12-31 10:10:03Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 December 2025, providing investors with an up-to-date view of the company's fundamentals, returns, and market standing.

Read full news article