Key Events This Week

29 Dec 2025: New 52-week and all-time high at Rs.503.9

30 Dec 2025: Record high of Rs.513.8 despite intraday volatility

2 Jan 2026: New 52-week and all-time high at Rs.536.4

Week Close: Rs.529.00 (+15.44%) vs Sensex +1.35%

Everest Organics Ltd is Rated Hold by MarketsMOJO

2026-01-03 10:10:05Everest Organics Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 05 Aug 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleWhy is Everest Organics Ltd falling/rising?

2026-01-03 01:45:00

Strong Price Momentum and Benchmark Outperformance

Everest Organics Ltd has demonstrated remarkable price appreciation over multiple time horizons, far exceeding the broader market represented by the Sensex. Over the past week, the stock surged by 15.44%, compared to a modest 0.85% gain in the Sensex. This momentum extended over the last month with a 27.95% increase, dwarfing the Sensex’s 0.73% rise. Even on a year-to-date basis, Everest Organics outpaced the benchmark with a 4.59% gain versus the Sensex’s 0.64%.

Looking at longer-term performance, the stock’s one-year return stands at an impressive 79.32%, vastly outperforming the Sensex’s 7.28%. Over three years, Everest Organics has delivered a staggering 330.78% return, compared to the Sensex’s 40.21%. Even on a fi...

Read full news article

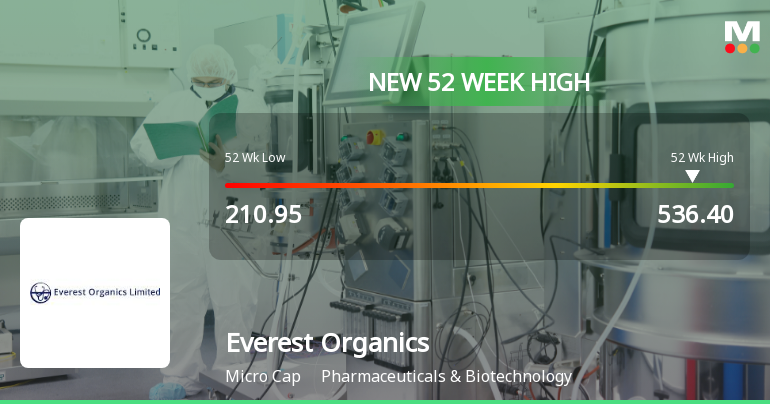

Everest Organics Ltd Hits New 52-Week High at Rs.536.4

2026-01-02 09:40:19Everest Organics Ltd, a key player in the Pharmaceuticals & Biotechnology sector, reached a significant milestone today by hitting a new 52-week high of Rs.536.4. This marks a remarkable surge in the stock price, reflecting strong momentum and sustained investor confidence over the past year.

Read full news article

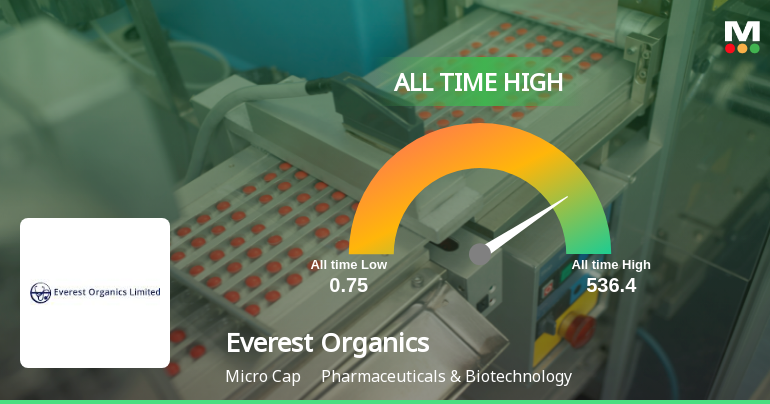

Everest Organics Ltd Hits All-Time High at Rs.536.4, Marking a Milestone in Pharmaceutical Sector

2026-01-02 09:31:18Everest Organics Ltd, a key player in the Pharmaceuticals & Biotechnology sector, reached a new all-time high of Rs.536.4 on 2 Jan 2026, underscoring its robust market performance and sustained investor confidence.

Read full news article