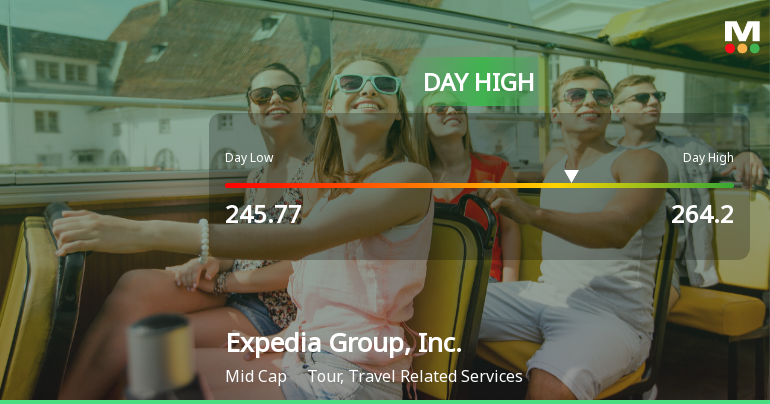

Expedia Group Stock Soars 17.55% to Intraday High of $264.20

2025-11-10 17:46:57Expedia Group, Inc. has shown remarkable stock performance, significantly outperforming the S&P 500. Over the past year, the company has achieved substantial growth, with impressive returns and high management efficiency. Its strong financial metrics and market capitalization reinforce its position in the travel services sector.

Read More

Expedia Group, Inc. Hits New 52-Week High of $264.20

2025-11-10 17:07:16Expedia Group, Inc. achieved a new 52-week high of USD 264.20 on November 7, 2025, reflecting strong performance in the travel industry with a one-year growth of 109.31%. The company has a market capitalization of USD 61,532 million and impressive financial metrics, indicating a solid balance sheet.

Read More

Expedia Group, Inc. Experiences Revision in Its Stock Evaluation Amid Strong Performance Metrics

2025-11-10 15:36:46Expedia Group, Inc. has recently adjusted its valuation, with its current price reflecting a significant increase. Over the past year, the company has shown strong performance, significantly outperforming the S&P 500. Key financial metrics indicate a competitive position within the travel industry, despite some challenges in capital employed.

Read MoreIs Expedia Group, Inc. overvalued or undervalued?

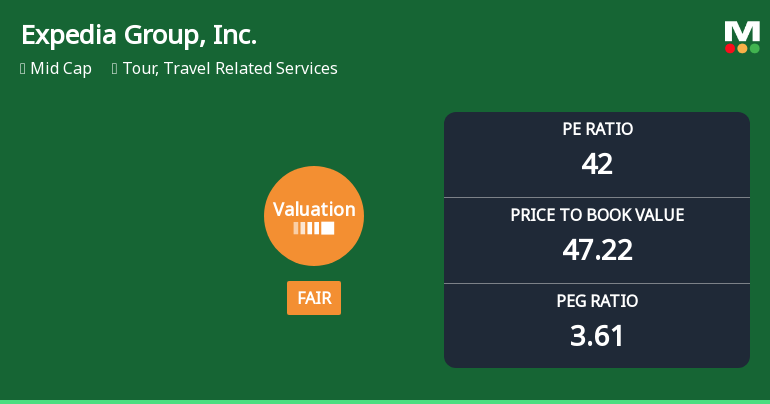

2025-10-21 12:07:44As of 17 October 2025, the valuation grade for Expedia Group, Inc. has moved from very expensive to fair. The company appears to be fairly valued based on its current metrics. Key ratios include a P/E ratio of 42, an EV to EBITDA of 20.19, and a Price to Book Value of 47.22. In comparison, its peer Rollins, Inc. has a higher P/E of 56.40 and a significantly higher PEG ratio of 11.17, indicating that Expedia is relatively more attractively priced within its industry. In terms of performance, Expedia has outperformed the S&P 500 over the 1-year period with a return of 35.92% compared to the index's 14.08%. However, over the 10-year period, it has underperformed, returning 136.75% versus the S&P 500's 227.77%. Overall, the current valuation suggests that while Expedia is fairly valued, it has shown strong recent performance relative to the broader market....

Read More

Expedia Group, Inc. Experiences Revision in Its Stock Evaluation Amid Strong Performance Metrics

2025-10-20 16:00:13Expedia Group, Inc. has recently adjusted its valuation, with its stock price reflecting a modest increase. Over the past year, the company has achieved a notable return, significantly exceeding the S&P 500. Key financial metrics indicate a strong return on equity, despite challenges with capital employed.

Read MoreIs Expedia Group, Inc. overvalued or undervalued?

2025-10-20 12:25:10As of 17 October 2025, the valuation grade for Expedia Group, Inc. moved from very expensive to fair. The company appears to be fairly valued at this time. Key valuation ratios include a P/E ratio of 42, an EV to EBITDA of 20.19, and a PEG ratio of 3.61. In comparison, peers such as Rollins, Inc. have a higher P/E ratio of 56.40 and a PEG ratio of 11.17, indicating that Expedia is relatively more attractively priced within its industry. In terms of recent performance, Expedia has outperformed the S&P 500 over the past year with a return of 35.92% compared to the S&P 500's 14.08%. However, over a longer time frame, such as 10 years, Expedia's return of 136.75% falls short of the S&P 500's 227.77%, suggesting that while the company is currently fairly valued, its long-term growth may not be as robust as the broader market....

Read MoreIs Expedia Group, Inc. overvalued or undervalued?

2025-10-19 12:02:46As of 17 October 2025, the valuation grade for Expedia Group, Inc. has moved from very expensive to fair. Based on the current metrics, the company appears to be fairly valued. Key ratios include a P/E ratio of 42, an EV to EBITDA of 20.19, and a PEG ratio of 3.61. In comparison, peers such as Rollins, Inc. have a higher P/E of 56.40 and an EV to EBITDA of 35.08, indicating that Expedia is relatively more attractively priced within its industry. Recent stock performance shows that Expedia has outperformed the S&P 500 over the last year, returning 35.92% compared to the index's 14.08%. This strong performance, coupled with its fair valuation, suggests that the stock is positioned well in the current market environment....

Read More

Expedia Group, Inc. Experiences Revision in Stock Evaluation Amid Strong Market Performance

2025-10-14 15:49:38Expedia Group, Inc. has recently revised its evaluation amid changing market conditions. The company’s stock has shown strong performance over the past year, significantly outperforming the S&P 500. Technical indicators suggest a positive outlook, while the company has demonstrated resilience in navigating market challenges within the travel sector.

Read More

Expedia Group Shows Strong Management Efficiency and Investor Confidence Amid Market Adjustments

2025-10-14 15:44:34Expedia Group, Inc. has recently experienced an evaluation adjustment reflecting its strong market position. The company boasts a high return on equity and a low debt to EBITDA ratio, indicating solid financial health. Additionally, it has shown impressive long-term growth and strong institutional backing, outperforming the S&P 500 over the past year.

Read More