G S Auto International Ltd is Rated Sell

2026-02-08 10:10:41G S Auto International Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 08 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

G S Auto International Ltd Valuation Improves Amid Mixed Market Returns

2026-02-01 08:03:21G S Auto International Ltd has witnessed a notable shift in its valuation parameters, moving from a very attractive to an attractive rating, reflecting a subtle but meaningful improvement in price appeal relative to its historical and peer benchmarks. Despite a modest day gain of 2.27%, the stock’s current price of ₹32.00 and valuation metrics suggest a recalibration of investor sentiment amid mixed financial signals and sector dynamics.

Read full news articleAre G S Auto International Ltd latest results good or bad?

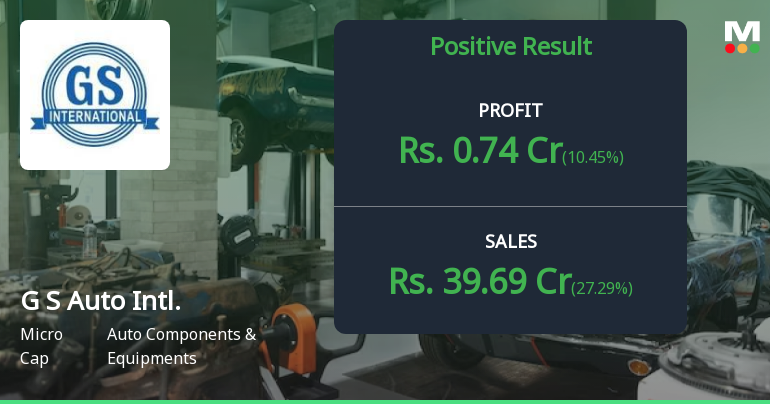

2026-01-30 19:23:49G S Auto International Ltd's latest financial results for Q3 FY26 indicate a notable turnaround in its operational performance. The company reported a net profit of ₹0.74 crores, marking a return to profitability after a prolonged period of losses. Additionally, revenue reached ₹39.69 crores, which is the highest quarterly figure in recent history, reflecting a significant recovery in sales. The operating margin improved to 6.88%, showcasing better operational efficiency compared to previous periods. The quarterly results highlight a growth trajectory, with net sales showing a quarter-on-quarter increase of 27.29% from the previous quarter. The standalone net profit also experienced a growth of 10.45%, indicating a positive trend in profitability. However, despite these improvements, the company continues to face challenges related to capital efficiency, as evidenced by low return on equity and return on c...

Read full news article

G S Auto International Q3 FY26: Turnaround Momentum Builds Despite Sector Headwinds

2026-01-29 22:17:21G S Auto International Ltd., the Ludhiana-based automotive components manufacturer, has posted its strongest quarterly performance in recent years for Q3 FY26, with net profit reaching ₹0.74 crores—marking a dramatic turnaround from consecutive quarters of losses. However, the micro-cap company's shares remained under pressure, trading at ₹30.25 on January 29, down 22.48% over the past year, significantly underperforming both the broader market and the auto components sector, which rallied 22.27% during the same period.

Read full news articleAre G S Auto International Ltd latest results good or bad?

2026-01-29 19:22:39G S Auto International Ltd's latest financial results reflect a company grappling with significant operational challenges. In the quarter ended September 2025, the company reported a net sales figure of ₹31.18 crores, which represents a decline of 17.14% compared to the previous quarter. This downturn follows a previous quarter where the company had shown a substantial growth of 37.63%, indicating a reversal in momentum. The operating profit for the same quarter was ₹2.65 crores, with an operating profit margin of 8.50%, which is an improvement from the previous margin of 6.94%. However, this positive trend in operating margin must be contextualized within the broader challenges the company faces, including a decline in revenue and persistent losses. Net profit for the quarter was reported at ₹0.67 crores, reflecting a growth of 9.84% from the prior quarter, but this follows a period of exceptionally high...

Read full news article

G S Auto International Ltd is Rated Strong Sell

2026-01-28 10:10:51G S Auto International Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 02 June 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

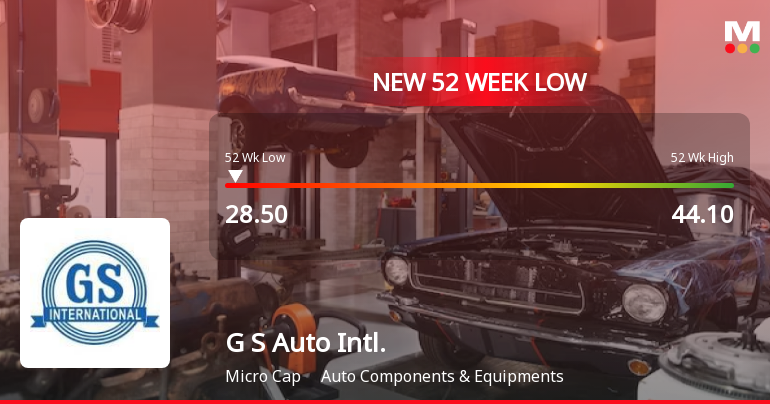

G S Auto International Ltd Falls to 52-Week Low of Rs.28.5

2026-01-22 14:37:18G S Auto International Ltd, a player in the Auto Components & Equipments sector, recorded a fresh 52-week low of Rs.28.5 today, reflecting a continued downward trajectory amid broader market fluctuations and company-specific factors.

Read full news article

G S Auto International Ltd Falls to 52-Week Low Amidst Market Pressure

2026-01-21 11:58:39Shares of G S Auto International Ltd touched a fresh 52-week low of Rs.29.01 today, marking a significant decline amid broader market headwinds and company-specific factors. The stock’s performance continues to lag behind sector peers and benchmark indices, reflecting ongoing concerns about its financial metrics and valuation.

Read full news article

G S Auto International Ltd Falls to 52-Week Low Amid Market Pressure

2026-01-19 12:12:40G S Auto International Ltd, a player in the Auto Components & Equipments sector, has touched a new 52-week low of Rs.29.11 today, marking a significant decline amid broader market fluctuations and company-specific factors.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSENewspaper publications of Extracts of Un-Audited Financial Results for the Quarter and Nine Months ended on 31st December 2025 along with QR Code and Web Page details in the Business Standard and Desh Sewak dated 31st January 2026

Unaudited Financial Results For The Quarter And Nine Months Ended 31.12.2025

29-Jan-2026 | Source : BSEAttached are the Un-Audited Financial Results for the Quarter and Nine Months ended 31.12.2025 along with Limited Review Report of Auditors thereon

Board Meeting Outcome for The Board In Its Meeting Held On 29.01.2026 Declared Unaudited Financial Results For The Quarter And Nine Months Ended 31.12.2025.

29-Jan-2026 | Source : BSEThe Board in its meeting held on 29.01.2026 declared Unaudited Financial Results for the Quarter and Nine months ended 31.12.2025. The meeting commenced at 5:00 P.M. and concluded at 7:00 P.M.

Corporate Actions

No Upcoming Board Meetings

G S Auto International Ltd has declared 11% dividend, ex-date: 22 Sep 11

G S Auto International Ltd has announced 5:10 stock split, ex-date: 20 Aug 08

No Bonus history available

No Rights history available