Persistent Downtrend Against Market Benchmarks

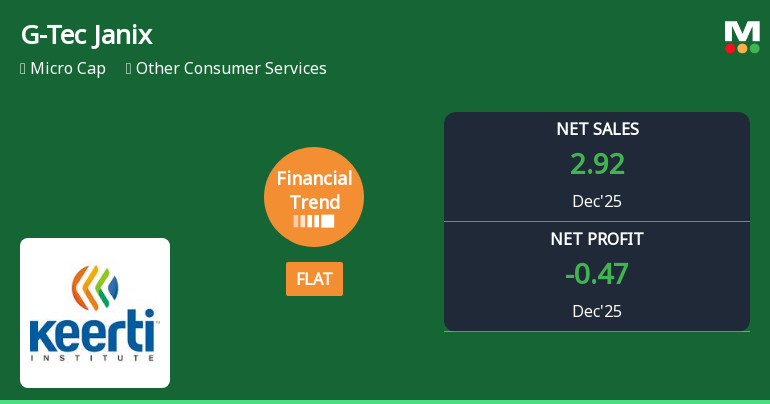

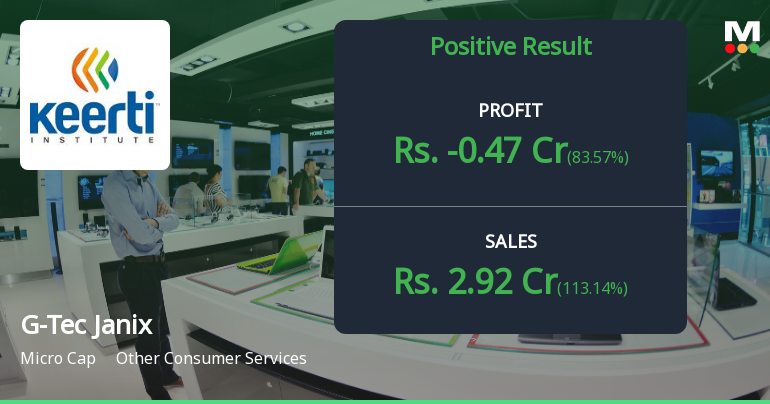

G-Tec Janix Education Ltd has been on a downward trajectory for an extended period. Over the past week, the stock declined by 10.51%, significantly underperforming the Sensex, which remained virtually flat with a marginal gain of 0.04%. The one-month performance further highlights this trend, with the stock falling 14.49% compared to the Sensex’s modest 0.64% decline. Year-to-date, the stock has lost 15.20%, while the broader market index has only dipped 1.67%. This stark contrast is even more pronounced over longer horizons, where the stock has delivered a negative 39.80% return over the last year, whereas the Sensex has gained 10.22%. Over three and five years, the divergence widens further, with the stock down 43.68% and 23.46...

Read full news article