Recent Price Movement and Market Context

Galactico Corporate Services Ltd’s stock price rose by ₹0.23, or 12.04%, as of 08:58 PM on 23-Jan, marking a significant uptick compared to its recent performance. This gain is particularly striking given the broader market context, where the Sensex index declined by 2.43% over the past week. The stock’s one-week return of +13.23% sharply contrasts with the benchmark’s negative movement, signalling a strong short-term investor interest in the company.

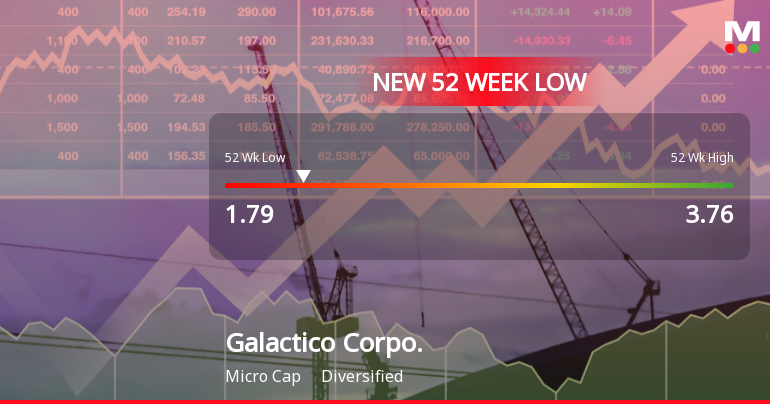

Despite this recent surge, the stock’s longer-term performance remains subdued. Over the past month, the share price has declined by 8.15%, underperforming the Sensex’s 4.66% drop. Year-to-date, the stock is down 1.83%, though this is still better than the Sensex’s 4.32% fall. Over...

Read full news article