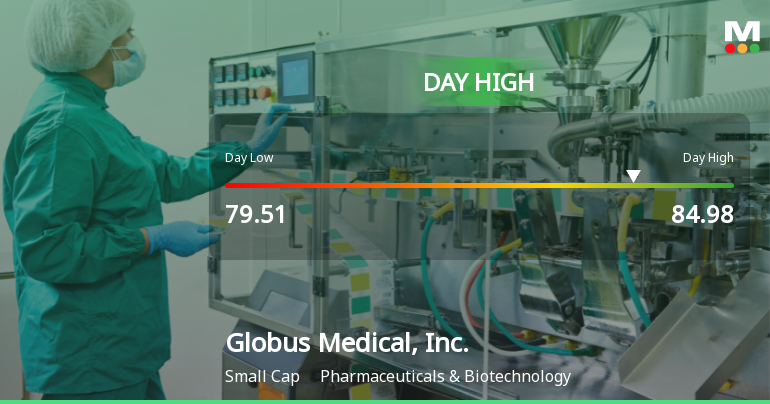

Globus Medical Hits Day High with 35.94% Surge in Stock Price

2025-11-10 17:52:04Globus Medical, Inc. has seen notable stock activity, achieving an intraday high and significant weekly and monthly gains. The company reported a substantial year-on-year net profit increase and maintains strong operating cash flow. With a low debt-to-equity ratio and high institutional holdings, it demonstrates solid financial stability and market position.

Read full news articleIs Globus Medical, Inc. overvalued or undervalued?

2025-11-05 11:10:33As of 31 October 2025, the valuation grade for Globus Medical, Inc. has moved from very attractive to attractive, indicating a shift in perceived value. The company appears to be overvalued based on its current metrics, with a P/E ratio of 36, a Price to Book Value of 1.98, and an EV to EBITDA of 13.54. Comparatively, its peers such as Masimo Corp. with a P/E of 179.74 and Merit Medical Systems, Inc. with a P/E of 42.46 suggest that Globus Medical's valuation is relatively high. In terms of performance, Globus Medical has underperformed against the S&P 500, with a year-to-date return of -25.45% compared to the index's 16.30%. This trend of underperformance, alongside its elevated valuation ratios, reinforces the conclusion that the stock is overvalued in the current market environment....

Read full news article

Globus Medical Experiences Valuation Adjustment Amid Competitive Market Landscape

2025-11-04 15:38:07Globus Medical, Inc. has recently adjusted its valuation, with its current price at $61.20. The company has faced challenges over the past year, reporting a return of -18.27%. Key financial metrics include a P/E ratio of 36 and a price-to-book value of 1.98, indicating its market position.

Read full news articleIs Globus Medical, Inc. overvalued or undervalued?

2025-11-04 11:16:31As of 31 October 2025, the valuation grade for Globus Medical, Inc. has moved from very attractive to attractive, indicating a shift in perceived value. The company appears to be overvalued based on its current metrics, particularly given its P/E ratio of 36, which is significantly higher than the peer average of 18.37 for comparable companies. Additionally, the EV to EBITDA ratio stands at 13.54, while peers like Lantheus Holdings, Inc. show a much lower ratio of 7.12, further suggesting that Globus Medical is priced at a premium compared to its industry counterparts. In comparison to its peers, Globus Medical's PEG ratio of 0.54 indicates potential growth, but this is overshadowed by its relatively high valuation ratios. Notably, Masimo Corp. has a P/E ratio of 179.74, while Merit Medical Systems, Inc. is at 42.46, both of which are higher than Globus Medical's P/E. The company's stock has underperformed...

Read full news articleIs Globus Medical, Inc. overvalued or undervalued?

2025-11-03 11:15:48As of 31 October 2025, the valuation grade for Globus Medical, Inc. has moved from very attractive to attractive, indicating a shift in perceived value. The company appears to be overvalued based on its current metrics, with a P/E ratio of 36, a Price to Book Value of 1.98, and an EV to EBITDA ratio of 13.54. In comparison to peers, Masimo Corp. has a P/E of 179.74, while Lantheus Holdings, Inc. shows a more favorable P/E of 10.13, suggesting that Globus Medical's valuation is relatively high. Recent performance against the S&P 500 further underscores this valuation concern, as the stock has returned -26.99% year-to-date compared to the index's gain of 16.30%. This stark contrast in returns highlights the challenges facing Globus Medical in the current market environment....

Read full news articleIs Globus Medical, Inc. overvalued or undervalued?

2025-11-02 11:09:00As of 31 October 2025, the valuation grade for Globus Medical, Inc. has moved from very attractive to attractive, indicating a shift in perceived value. The company appears to be overvalued, particularly when considering its P/E ratio of 36, which is significantly higher than the peer average of 18.37 for similar companies. Additionally, the EV to EBITDA ratio stands at 13.54, while the industry average is much lower, suggesting that the company is trading at a premium compared to its peers. In comparison to notable peers, Masimo Corp. has a P/E ratio of 179.74, while Lantheus Holdings, Inc. is more attractively valued at 10.13. The stock has underperformed against the S&P 500, with a year-to-date return of -26.99% compared to the index's 16.30%, reinforcing the notion that the stock may be overvalued at its current price of 60.39....

Read full news article