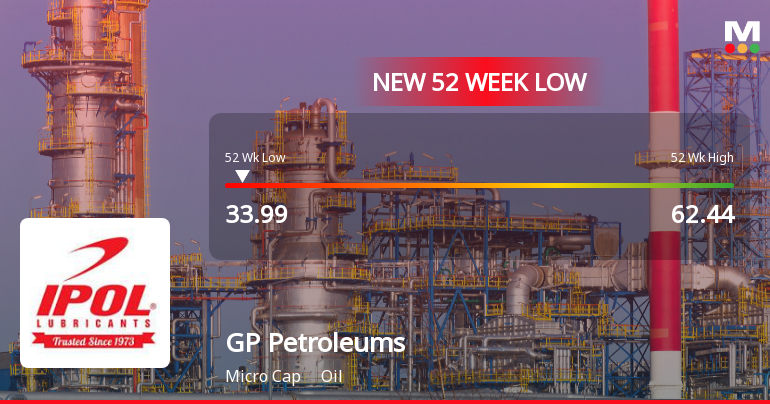

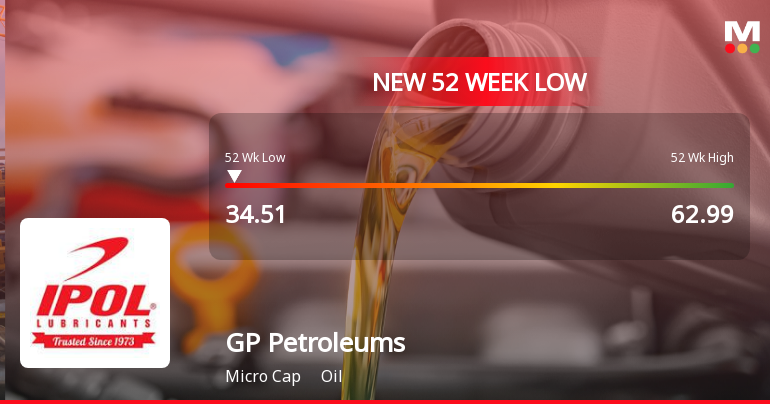

Valuation Metrics Indicate Attractiveness

GP Petroleums trades at a price-to-earnings (PE) ratio of approximately 7, which is considerably lower than many of its oil sector peers. For instance, Castrol India and Gulf Oil Lubricants command PE ratios well above 15, reflecting higher market expectations for growth or profitability. The company’s price-to-book value stands at 0.56, signalling that the stock is priced below its net asset value, a classic indicator of undervaluation in value investing circles.

Enterprise value multiples further reinforce this view. GP Petroleums’ EV to EBITDA ratio is around 5.2, markedly lower than peers such as Castrol India and Savita Oil Technologies, which trade at multiples exceeding 12. This suggests the market values GP Petroleums’ ...

Read More