Greenidge Generation Holdings, Inc. Experiences Revision in Stock Evaluation Amid Financial Challenges

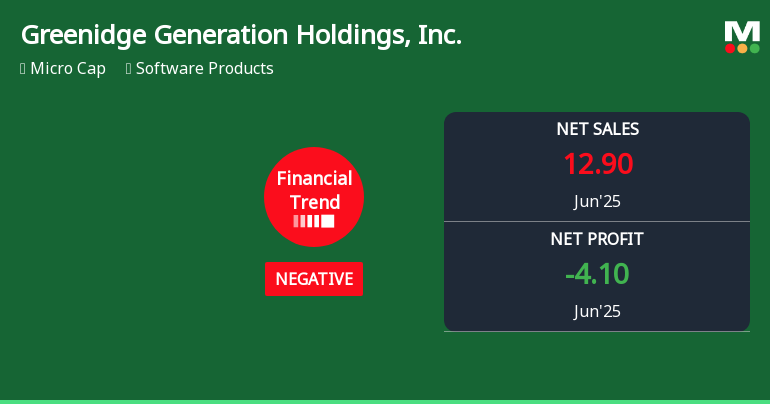

2025-11-20 15:45:28Greenidge Generation Holdings, Inc. reported significant financial challenges for the quarter ending June 2025, with notable losses in key metrics. Operating cash flow reached USD -16.08 million, and net profit for the half-year was USD -9.68 million. The company also faced rising raw material costs and declining net sales.

Read full news articleNo announcement available

Corporate Actions

No corporate action available