Is HF Sinclair Corp. technically bullish or bearish?

2025-11-05 11:25:01As of 31 October 2025, the technical trend for HF Sinclair Corp. has changed from bullish to mildly bullish. The weekly MACD is mildly bearish, while the monthly MACD is bullish, indicating mixed signals across time frames. The daily moving averages are bullish, supporting a positive short-term outlook. Bollinger Bands show bullish conditions for both weekly and monthly periods. However, the KST is mildly bearish on the weekly and mildly bullish on the monthly, suggesting some uncertainty. Dow Theory and OBV indicate no clear trends. In terms of performance, HF Sinclair has outperformed the S&P 500 year-to-date with a return of 52.52% compared to the S&P 500's 16.30%, and over the past year with 38.14% versus 19.89%. However, it has underperformed over the 3-year period. Overall, the current technical stance is mildly bullish, driven by the daily moving averages and monthly MACD, despite some bearish indic...

Read full news articleIs HF Sinclair Corp. technically bullish or bearish?

2025-11-03 11:36:40As of 31 October 2025, the technical trend for HF Sinclair Corp. has changed from bullish to mildly bullish. The weekly MACD is bullish, while the monthly MACD is mildly bullish. The Bollinger Bands indicate a mildly bullish stance for both weekly and monthly periods. Daily moving averages also reflect a mildly bullish trend. However, the KST shows a mildly bearish signal on the weekly timeframe, and the Dow Theory indicates no trend on the weekly but mildly bullish on the monthly. In terms of performance, HF Sinclair has outperformed the S&P 500 year-to-date with a return of 47.22% compared to 16.30%, and over the past year, it has returned 33.64% against the S&P 500's 19.89%. However, over the 3-year period, it has underperformed significantly with a return of -15.64% versus the S&P 500's 76.66%. Overall, the current technical stance is mildly bullish, supported by several indicators, despite some mixed ...

Read full news articleIs HF Sinclair Corp. technically bullish or bearish?

2025-11-02 11:20:26As of 31 October 2025, the technical trend for HF Sinclair Corp. has changed from bullish to mildly bullish. The weekly MACD indicates a bullish stance, while the monthly MACD is mildly bullish. The Bollinger Bands also reflect a mildly bullish trend on both weekly and monthly time frames. However, the KST shows a mildly bearish signal on the weekly chart, which contrasts with the monthly mildly bullish reading. The daily moving averages are mildly bullish, and the OBV supports this with a mildly bullish indication on both time frames. In terms of performance, HF Sinclair has outperformed the S&P 500 year-to-date and over the past year, with returns of 47.22% and 33.64%, respectively, compared to the S&P 500's 16.30% and 19.89%. However, over the longer three-year period, it has underperformed the benchmark significantly, with a return of -15.64% versus 76.66% for the S&P 500. Overall, the current technic...

Read full news articleIs HF Sinclair Corp. technically bullish or bearish?

2025-10-28 11:46:31As of 24 October 2025, the technical trend for HF Sinclair Corp. has changed from mildly bullish to bullish. The weekly MACD is bullish, supported by bullish signals from both the Bollinger Bands and daily moving averages. However, the KST shows a mildly bearish stance on the weekly timeframe, while the monthly indicators are mostly mildly bullish. The Dow Theory indicates a mildly bullish trend on both weekly and monthly bases. In terms of performance, HF Sinclair has outperformed the S&P 500 over the year with a return of 27.10% compared to the S&P's 16.90%, and it has also shown strong returns year-to-date at 55.61% versus 15.47% for the S&P 500. Overall, the current technical stance is bullish, reflecting a strong upward momentum....

Read full news article

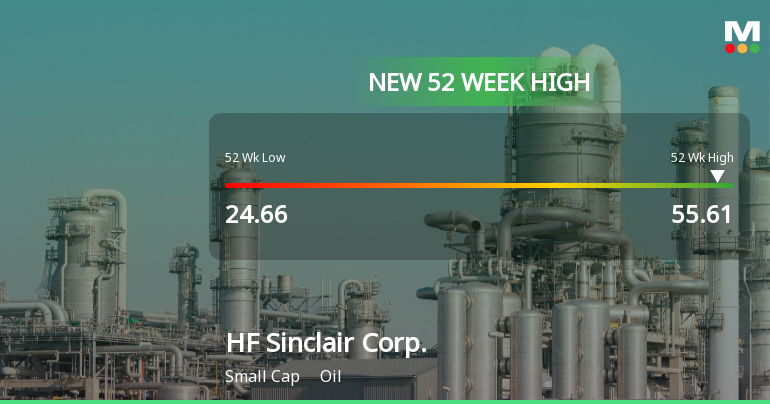

HF Sinclair Corp. Hits New 52-Week High at $55.61

2025-10-27 17:05:20HF Sinclair Corp. achieved a new 52-week high of USD 55.61 on October 24, 2025, significantly up from its low of USD 24.66. The company, with a market cap of approximately USD 14,335 million, operates in the oil industry and offers a notable dividend yield, despite facing some financial challenges.

Read full news articleIs HF Sinclair Corp. technically bullish or bearish?

2025-10-26 11:33:01As of 24 October 2025, the technical trend for HF Sinclair Corp. has changed from mildly bullish to bullish. The current stance is bullish with strong indicators supporting this view. The MACD is bullish on the weekly timeframe, and both the Bollinger Bands and daily moving averages are also bullish. However, the KST shows a mildly bearish signal on the weekly, which slightly tempers the overall bullish sentiment. In terms of performance, HF Sinclair has outperformed the S&P 500 with a year-to-date return of 55.61% compared to the S&P's 15.47%, and a one-year return of 27.10% versus 16.90% for the index. Overall, the technical indicators suggest a strong bullish momentum for the stock....

Read full news article