Recent Price Movement and Market Context

Hisar Metal Industries Ltd opened the day with a gap up, immediately trading at ₹171, which was also the intraday high. The stock demonstrated high volatility throughout the session, with an intraday volatility of 8.44% based on the weighted average price. This price action contrasts with the broader market, as the Sensex declined by 0.39% over the past week, while Hisar Metal gained 6.88% in the same period. Year-to-date, the stock has risen 5.69%, whereas the Sensex has fallen 3.95%, highlighting the stock’s relative strength in recent trading sessions.

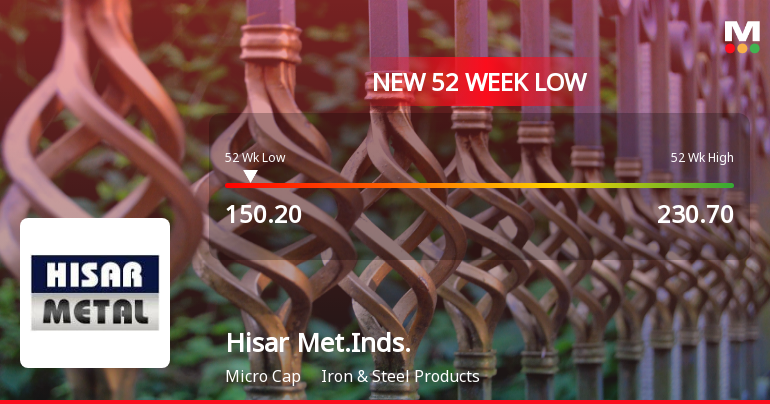

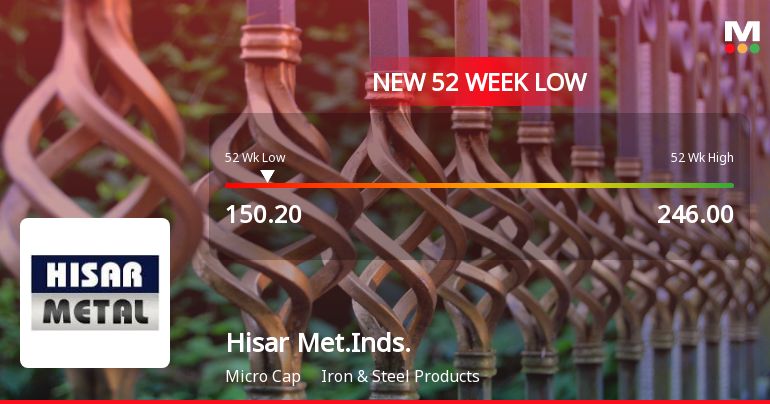

Despite this short-term rally, the stock’s longer-term performance remains subdued. Over the past year, Hisar Metal Industries has delivered a negative return of 13.68%, underp...

Read full news article