Recent Price Movement and Market Context

The stock has been on a downward trajectory for six consecutive trading sessions, accumulating a loss of 6.63% over this period. This decline is notably sharper than the broader market, with the Sensex remaining almost flat during the past week. Over the last month, Honda India Power Products has declined by 7.36%, significantly underperforming the Sensex’s 1.31% fall. Year-to-date, the stock has dropped 7.91%, compared to the Sensex’s modest 1.94% decline. The one-year performance is particularly concerning, with the stock losing 19.14% while the Sensex gained 8.47%, highlighting a persistent lag behind the benchmark index.

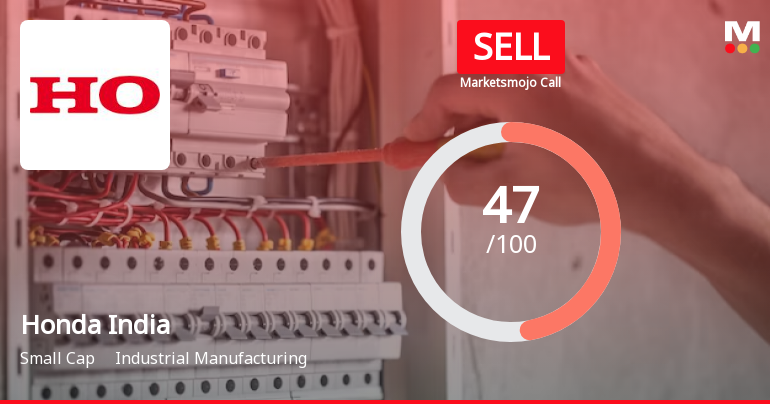

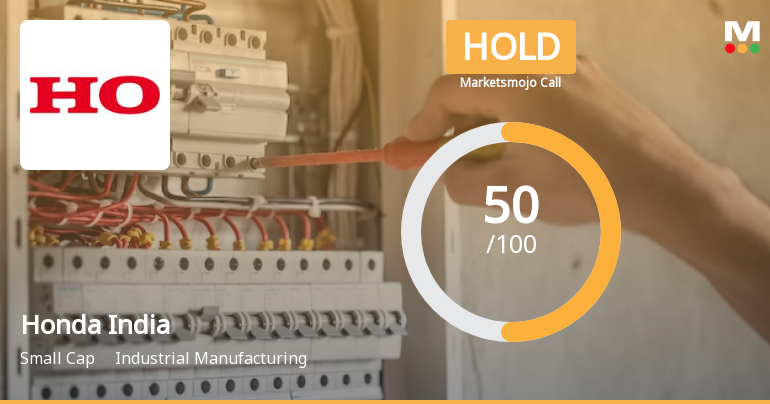

Technical indicators also paint a bearish picture. The share price is trading below all key moving averag...

Read full news article