Key Events This Week

2 Feb: Q3 FY26 results reveal margin pressure despite revenue growth

3 Feb: Valuation shifts to fair amid strong operational metrics

6 Feb: Week closes at Rs.2,185.05 (-0.65%)

Feb 06

BSE+NSE Vol: 2.72 lacs

2 Feb: Q3 FY26 results reveal margin pressure despite revenue growth

3 Feb: Valuation shifts to fair amid strong operational metrics

6 Feb: Week closes at Rs.2,185.05 (-0.65%)

Hyundai Motor India Ltd is rated Buy by MarketsMOJO, with this rating last updated on 08 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

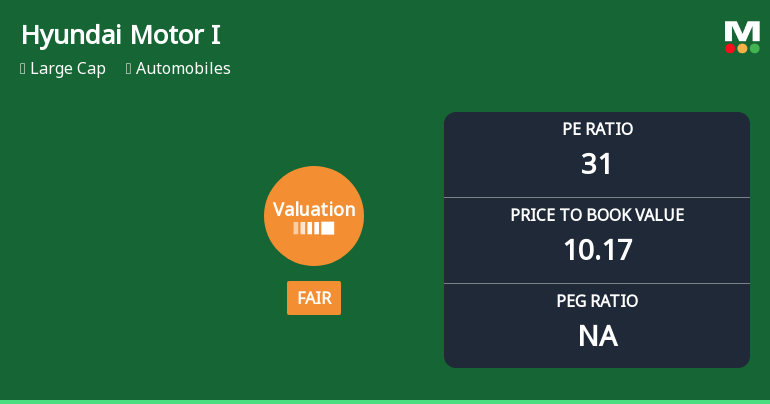

Hyundai Motor India Ltd has experienced a notable shift in its valuation parameters, moving from an attractive to a fair rating as of December 2025. This change reflects evolving market perceptions amid robust financial performance and sector-wide valuation trends. Investors are now reassessing the company’s price-to-earnings and price-to-book ratios in comparison to historical averages and peer benchmarks, signalling a nuanced outlook for the automobile giant.

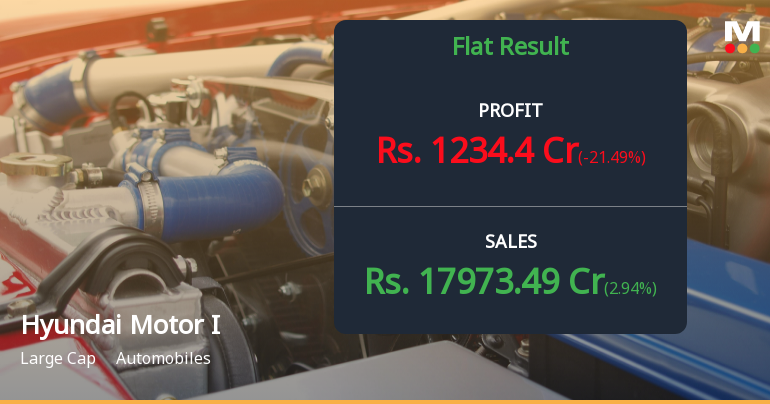

Read full news articleHyundai Motor India Ltd's latest financial results for Q3 FY26 reveal a complex picture of operational performance. The company achieved a record quarterly revenue of ₹17,973.49 crores, reflecting a sequential growth of 2.94% and a year-on-year increase of 7.96%. This growth was primarily driven by strong demand for its SUV portfolio, including popular models like the Creta and Venue. However, despite this top-line growth, the company faced significant challenges in profitability metrics. Net profit for the quarter was reported at ₹1,234.40 crores, which, while representing a year-on-year improvement of 6.35%, marked a notable quarter-on-quarter decline of 21.49%. This decline in profitability is indicative of the pressures faced by the company, including rising input costs and increased promotional expenses during the festive season. The operating margin also contracted sharply from 14.16% in the previous...

Read full news article

Hyundai Motor India Ltd., the country's second-largest passenger vehicle manufacturer, reported a mixed performance for Q3 FY26, with net profit declining 21.49% quarter-on-quarter to ₹1,234.40 crores despite revenue growth of 2.94% to ₹17,973.49 crores. The stock traded at ₹2,196.50 on February 02, 2026, representing a market capitalisation of ₹1,74,058 crores, as investors digested margin compression concerns that overshadowed the company's solid year-on-year revenue expansion of 7.96%.

Read full news articleThe next results date for Hyundai Motor India Ltd is scheduled for February 2, 2026....

Read full news article

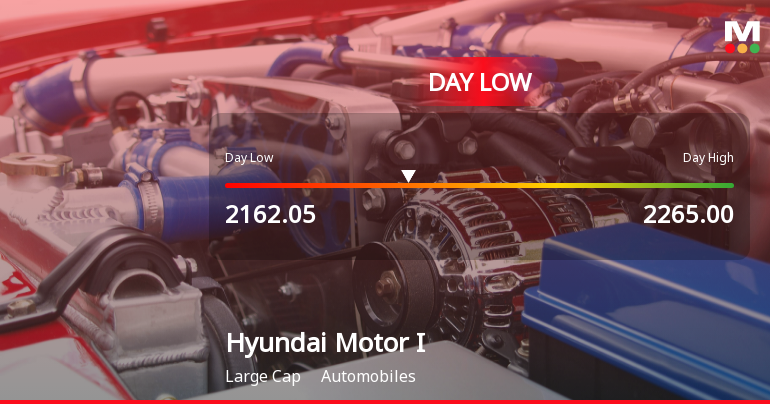

Hyundai Motor India Ltd experienced a notable decline today, touching an intraday low of Rs 2208.05 as the stock faced sustained selling pressure amid broader market weakness and sectoral underperformance.

Read full news article

Hyundai Motor India Ltd is rated Buy by MarketsMOJO, with this rating last updated on 08 December 2025. While the rating change occurred then, the analysis and financial metrics discussed here reflect the stock's current position as of 26 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

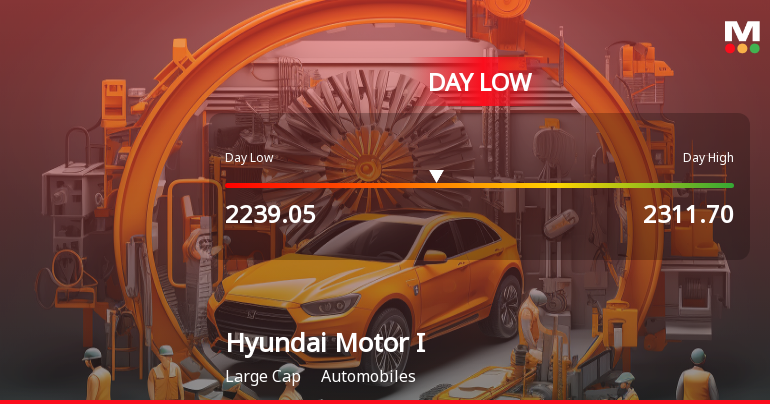

Hyundai Motor India Ltd experienced a notable decline today, touching an intraday low of Rs 2,239.05, reflecting a 3.41% drop as the stock faced significant price pressure amid broader market weakness and sector underperformance.

Read full news articleAnalyst/ Investor Meet

Results

Outcome of Board Meeting

No Upcoming Board Meetings

Hyundai Motor India Ltd has declared 210% dividend, ex-date: 05 Aug 25

No Splits history available

No Bonus history available

No Rights history available