i3 Verticals, Inc. Experiences Revision in Its Stock Evaluation Amid Mixed Performance

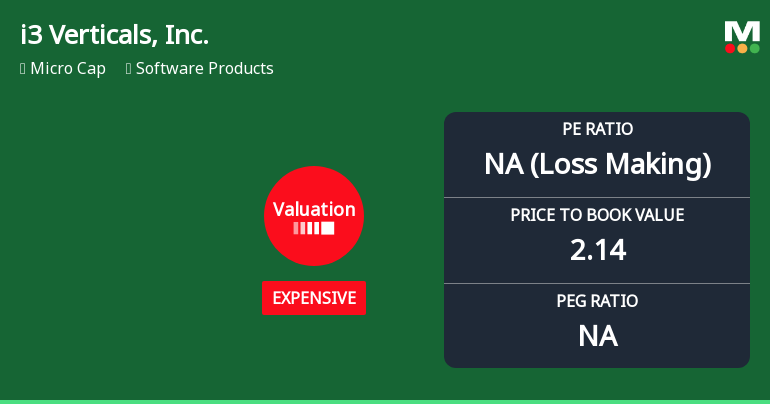

2025-11-10 16:17:28i3 Verticals, Inc. has recently adjusted its valuation, reflecting a loss-making status with a P/E ratio of 86.60. Key financial metrics indicate a high EV to EBIT ratio and a low return on equity. Despite a strong year-to-date performance, the company has underperformed over longer periods compared to the S&P 500.

Read full news articleNo announcement available

Corporate Actions

No corporate action available