Key Events This Week

5 Jan: Stock opens at Rs.34.84 amid subdued market

6 Jan: Surges to upper circuit with 19.98% gain

7 Jan: Technical upgrade to Sell rating announced

9 Jan: Week closes at Rs.36.27, outperforming Sensex

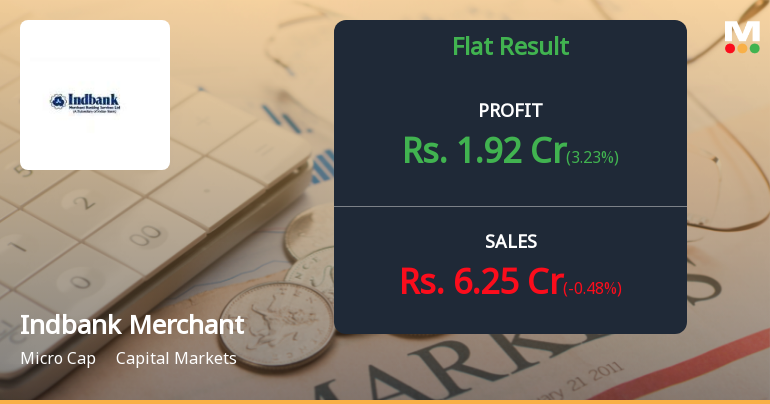

Why is Indbank Merchant Banking Services Ltd falling/rising?

2026-01-10 01:04:34

Recent Price Movement and Market Context

Indbank Merchant Banking Services Ltd has been under pressure in the immediate term, with the stock declining for three consecutive days, resulting in a cumulative loss of 13.76% over this period. On 09-Jan, the share price touched an intraday low of ₹35.55, representing a 4.07% drop from the previous close. This short-term weakness contrasts with the stock's performance over the past week and month, where it recorded gains of 2.91% and 2.04% respectively, while the Sensex declined by 2.55% and 1.29% over the same periods. Year-to-date, the stock has also outpaced the benchmark, rising 2.71% compared to the Sensex's 1.93% fall.

Despite these recent gains, the stock remains down 17.03% over the last year, underperforming the Sens...

Read full news article