Key Events This Week

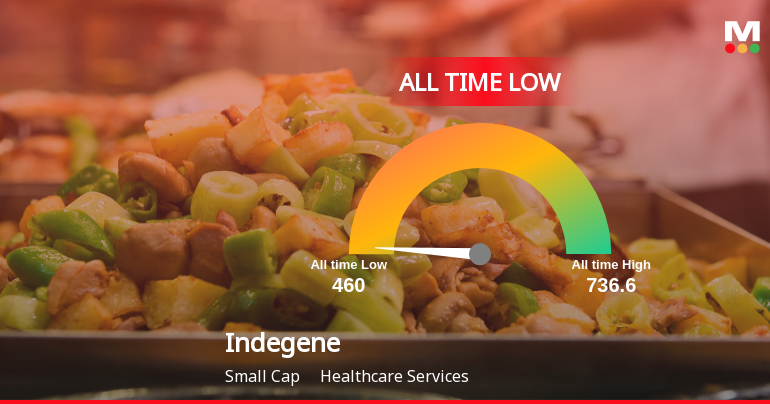

27 Jan: Stock hits 52-week and all-time low near Rs.462

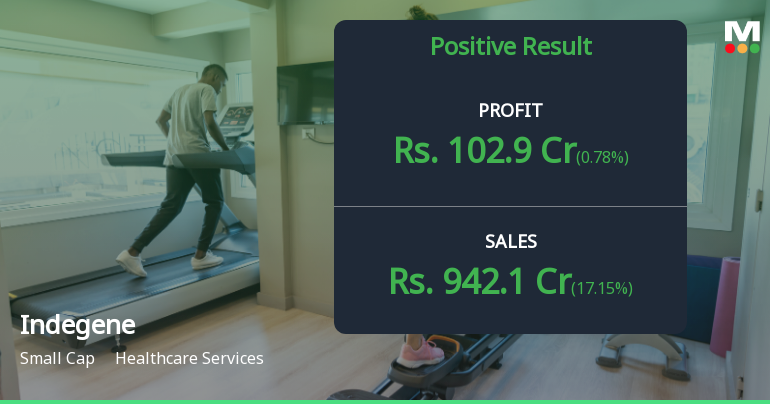

29 Jan: Q2 FY26 results reveal margin compression despite revenue growth

30 Jan: Stock falls again to 52-week low of Rs.455.8 amid market pressure

30 Jan: Week closes at Rs.482.20 (+1.73%) outperforming Sensex