Indian Card Clothing Company Ltd Falls to 52-Week Low of Rs.195

2026-03-04 11:27:21Indian Card Clothing Company Ltd, a player in the Garments & Apparels sector, has reached a new 52-week low of Rs.195 today, marking a significant decline amid ongoing downward momentum. The stock has underperformed its sector and broader market indices, reflecting persistent challenges in its financial and operational metrics.

Read full news article

Indian Card Clothing Company Ltd Hits 52-Week Low Amidst Continued Downtrend

2026-03-04 11:27:18Indian Card Clothing Company Ltd has reached a new 52-week low of Rs.195 today, marking a significant decline in its stock price amid ongoing financial pressures and sector underperformance.

Read full news article

Indian Card Clothing Company Ltd Hits 52-Week Low Amidst Continued Downtrend

2026-03-02 14:18:53Indian Card Clothing Company Ltd has reached a new 52-week low of Rs.201.9, marking a significant decline in its stock price amid ongoing financial pressures and sectoral headwinds. The stock’s recent performance reflects a continuation of downward momentum, with notable underperformance relative to its sector and benchmark indices.

Read full news article

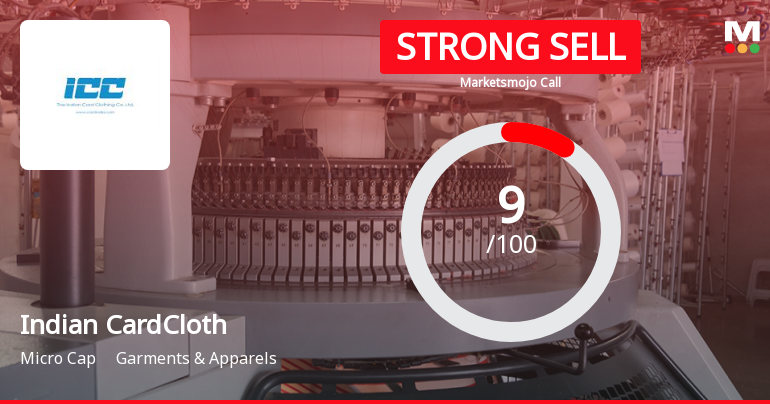

Indian Card Clothing Company Ltd is Rated Strong Sell

2026-03-02 10:10:36Indian Card Clothing Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 18 Aug 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics discussed here are based on the company’s current position as of 02 March 2026, providing investors with the latest insights into its performance and prospects.

Read full news article

Indian Card Clothing Company Ltd Falls to 52-Week Low of Rs.207

2026-02-27 11:20:50Indian Card Clothing Company Ltd has touched a new 52-week low of Rs.207 today, marking a significant decline in its stock price amid broader market weakness and company-specific financial pressures.

Read full news article

Indian Card Clothing Company Ltd Stock Falls to 52-Week Low of Rs 209.1

2026-02-26 13:40:12Indian Card Clothing Company Ltd has touched a fresh 52-week low, closing just 0.43% above its lowest price of Rs 209.1. This marks a significant milestone in the stock’s recent performance, reflecting ongoing pressures within the Garments & Apparels sector and the company’s financial metrics.

Read full news article

Indian Card Clothing Company Ltd Hits 52-Week Low Amidst Continued Decline

2026-02-24 11:22:13Indian Card Clothing Company Ltd has touched a new 52-week low of Rs.213.05 today, marking a significant decline amid ongoing market pressures and company-specific headwinds. The stock has underperformed its sector and benchmark indices, reflecting persistent challenges in its financial performance and market positioning.

Read full news article

Indian Card Clothing Company Ltd is Rated Strong Sell

2026-02-19 10:10:26Indian Card Clothing Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 18 August 2025, reflecting a significant reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are based on the company’s current position as of 19 February 2026, providing investors with the latest comprehensive analysis.

Read full news articleAre Indian Card Clothing Company Ltd latest results good or bad?

2026-02-12 19:31:16The latest financial results for Indian Card Clothing Company Ltd. reveal a challenging operational landscape. In Q3 FY26, the company reported a net loss of ₹0.61 crores, marking a significant shift from profitability to loss compared to the previous quarter. Year-on-year, while there was a 144.00% improvement in net profit, this merely reflects a narrower loss compared to the same quarter last year, indicating ongoing struggles. Net sales for the quarter stood at ₹10.41 crores, which represents a decline of 2.98% from the previous quarter and a 1.42% decrease compared to the same quarter last year. This marks the second consecutive quarter of revenue contraction, highlighting a concerning trend of declining sales over time. The operating margin, excluding other income, was reported at -31.99%, indicating persistent operational inefficiencies and the inability of the core business to generate positive ca...

Read full news articleIndian Card Clothing Company Limited - Clarification

18-Nov-2019 | Source : NSEIndian Card Clothing Company Limitedmited with respect to announcement dated 08-Nov-2019, regarding Board meeting held on November 08, 2019. On basis of above the Company is required to clarify following: 1. Brief profile (in case of appointment). The response of the Company is awaited.

Indian Card Clothing Company Limited - Shareholders meeting

04-Nov-2019 | Source : NSEIndian Card Clothing Company Limited has informed the Exchange regarding Notice of Postal Ballot

Indian Card Clothing Company Limited - Credit Rating

18-Oct-2019 | Source : NSEIndian Card Clothing Company Limited has informed the Exchange regarding Credit Rating that ICRA Limited, the Credit Rating Agency has reaffirmed the long-term rating at [ICRA]BB+ (pronounced ICRA double B plus) and short-term rating at [ICRA]A4+ (pronounced ICRA A four plus) assigned to the line of credit of the Company. The communication letter and rationale as received from ICRA Limited is enclosed.

Corporate Actions

No Upcoming Board Meetings

Indian Card Clothing Company Ltd has declared 250% dividend, ex-date: 07 Jul 22

No Splits history available

No Bonus history available

No Rights history available