Recent Price Movement and Market Comparison

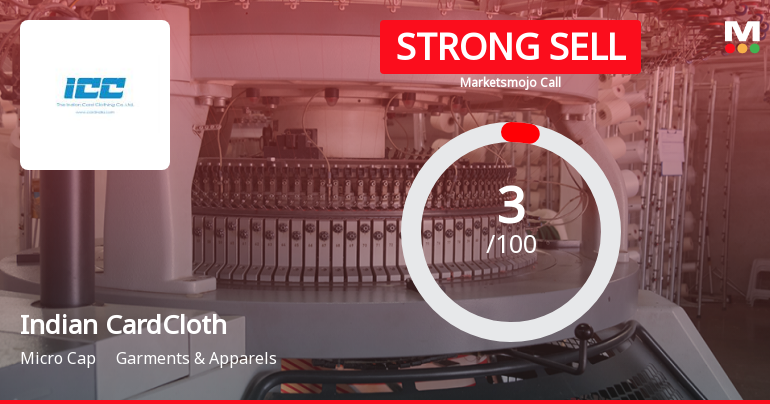

Indian Card Clothing’s stock has been under pressure in recent weeks, with a one-week decline of 3.92% and a one-month drop of 6.52%. These figures contrast sharply with the broader Sensex index, which recorded marginal gains of 0.01% over the week and 2.70% over the month. Year-to-date, the stock has fallen by a significant 27.42%, while the Sensex has advanced by 9.69%. This divergence highlights the stock’s underperformance relative to the broader market.

On the day in question, the stock underperformed its sector by 1.94%, touching an intraday low of Rs 240.25. Notably, Indian Card Clothing is trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a bearish tr...

Read full news article