Key Events This Week

2 Feb: Rating upgraded to Hold on improved valuation and financial trends

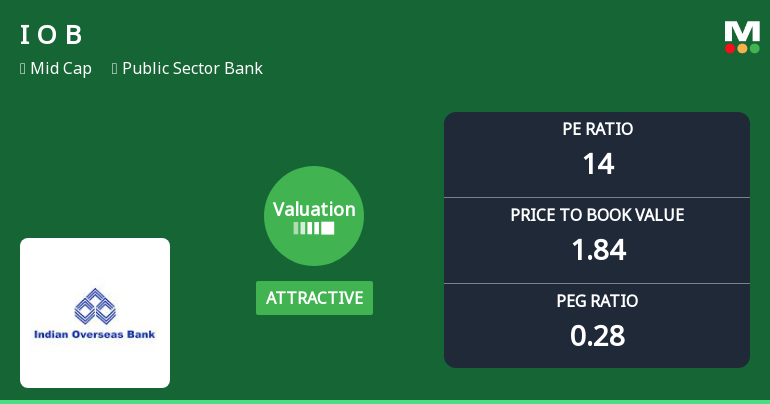

3 Feb: Valuation grade shifted to Attractive amid mixed returns

5 Feb: Stock price declined despite positive market momentum

6 Feb: Week closes at Rs.34.83, down 2.16%

Indian Overseas Bank Upgraded to Hold on Improved Valuation and Financial Trends

2026-02-03 08:13:05Indian Overseas Bank (IOB) has seen its investment rating upgraded from Sell to Hold, driven primarily by an improved valuation outlook and robust financial performance. The bank’s quality metrics, financial trends, and technical indicators have been reassessed, resulting in a more favourable stance despite recent share price underperformance. This article analyses the four key parameters that influenced the rating change and what it means for investors.

Read full news article

Indian Overseas Bank Valuation Shifts to Attractive Amid Mixed Returns

2026-02-03 08:00:33Indian Overseas Bank (IOB) has seen a notable shift in its valuation parameters, moving from a fair to an attractive rating, driven primarily by its price-to-earnings (P/E) and price-to-book value (P/BV) ratios. This change comes amid a backdrop of mixed returns relative to the broader Sensex index, prompting investors to reassess the bank’s price attractiveness and growth prospects within the public sector banking space.

Read full news article

Indian Overseas Bank is Rated Sell

2026-01-25 10:10:30Indian Overseas Bank is rated 'Sell' by MarketsMOJO, with this rating last updated on 14 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleWhy is Indian Overseas Bank falling/rising?

2026-01-24 00:47:59

Recent Price Movement and Market Context

On 23 January, Indian Overseas Bank’s stock price slipped closer to its 52-week low, standing just 3.28% above the ₹33.01 mark. The stock underperformed the broader public banking sector, which itself declined by 2.14% on the day. Despite this, IOB marginally outperformed its sector peers by 0.26%, suggesting some relative resilience amid sector weakness.

However, the stock is trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling a bearish technical trend. Investor participation has also waned, with delivery volumes on 22 January falling by 42.8% compared to the five-day average, indicating reduced buying interest from market participants.

Are Indian Overseas Bank latest results good or bad?

2026-01-14 19:12:08Indian Overseas Bank's latest results for Q3 FY26 reflect notable operational trends, particularly in profitability and asset quality. The bank reported a net profit of ₹1,226.42 crores, which demonstrates a significant year-on-year growth of 57.81%. This performance is complemented by a net interest income of ₹3,059.14 crores, marking a year-on-year increase of 20.57%. Additionally, the total income for the quarter reached ₹9,214.24 crores, up 8.61% from the previous year. The asset quality metrics also show improvement, with the gross non-performing asset (NPA) ratio declining to 1.83% from 2.72% a year ago, and net NPAs reducing to 0.28%. This indicates effective credit management and provisioning practices, as the provision coverage ratio remains robust at 97.48%. On a quarter-on-quarter basis, the bank's net profit advanced by 10.38%, reflecting consistent operational resilience. However, the interes...

Read full news article

Indian Overseas Bank Q3 FY26: Strong Profit Growth Masks Valuation Concerns

2026-01-14 15:16:43Indian Overseas Bank Ltd. (IOB) reported a robust Q3 FY26 performance with net profit surging 57.81% year-on-year to ₹1,226.42 crores, marking the bank's strongest quarterly profit in recent history. However, the stock continues to languish in bearish territory, trading at ₹36.08 with a market capitalisation of ₹69,112 crores, down 33.32% over the past year despite the impressive earnings momentum.

Read full news article

Indian Overseas Bank Upgraded to Hold by MarketsMOJO on Improved Fundamentals

2026-01-14 08:10:25Indian Overseas Bank (IOB) has seen its investment rating upgraded from Sell to Hold, reflecting significant improvements in its quality metrics, financial trends, and valuation parameters. The upgrade, effective from 13 January 2026, comes amid a backdrop of strong quarterly performance, enhanced asset quality, and a more favourable risk profile, signalling a cautious but positive outlook for this public sector bank.

Read full news article

Indian Overseas Bank Quality Upgrade Signals Improving Fundamentals Amid Mixed Returns

2026-01-14 08:00:08Indian Overseas Bank (IOB) has seen its quality grade upgraded from average to good, reflecting notable improvements in key financial metrics such as net profit growth and asset quality. However, the bank’s performance remains nuanced, with certain areas like return on assets and capital adequacy showing room for further enhancement. This article analyses the recent changes in IOB’s business fundamentals, including profitability ratios, asset quality, and capital structure, to provide a comprehensive view of its evolving financial health.

Read full news article