Key Events This Week

2 Feb: Q3 FY26 results reveal 55.64% profit decline despite revenue growth

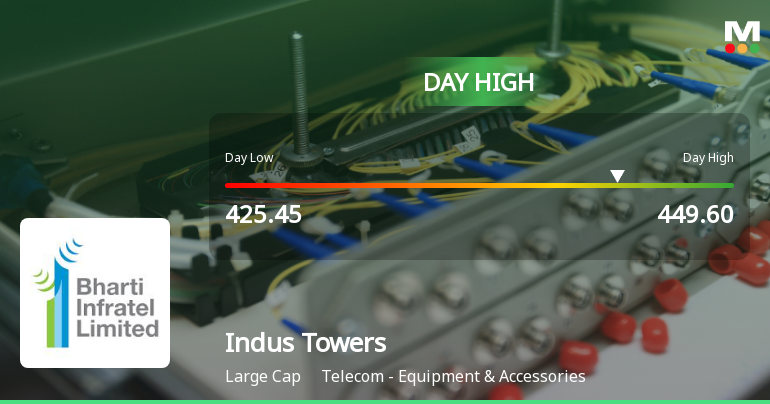

3 Feb: Intraday high surge of 3.54% to Rs.449.60 amid strong technical momentum

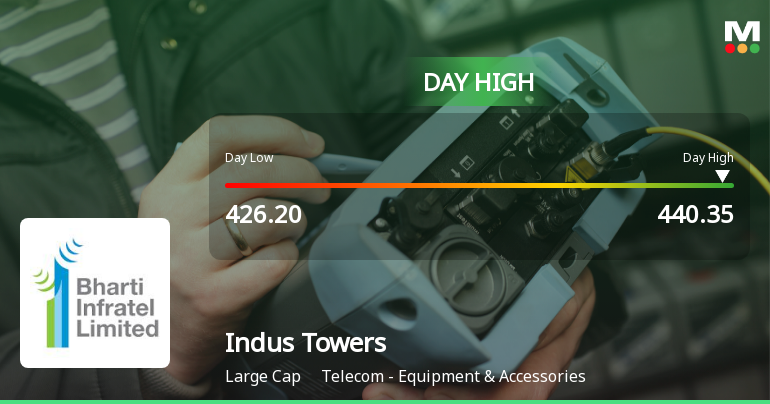

4 Feb: Continued price gains with moderate volume support

5 Feb: Minor pullback of 0.53% as market consolidates

6 Feb: Week closes at Rs.443.40, down 0.12% for the week

Indus Towers Ltd is Rated Hold

2026-02-04 10:10:04Indus Towers Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 07 Nov 2025. While this rating change occurred several months ago, the analysis and financial metrics presented here reflect the stock’s current position as of 04 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news articleAre Indus Towers Ltd latest results good or bad?

2026-02-03 19:15:31Indus Towers Ltd reported its financial results for Q3 FY26, revealing a complex operational landscape. The company achieved net sales of ₹8,146.30 crores, reflecting a year-on-year revenue growth of 7.94% compared to ₹7,547.40 crores in the same quarter last year. However, there was a slight sequential decline of 0.51% from ₹8,188.20 crores in the previous quarter, indicating potential challenges in maintaining revenue momentum. In terms of profitability, the net profit for the quarter stood at ₹1,775.90 crores, which represents a significant year-on-year decline of 55.64% from an exceptionally high base in Q3 FY25, where the profit was ₹4,003.20 crores. On a sequential basis, net profit decreased by 3.45% from ₹1,839.30 crores in Q2 FY26. This decline in profit, while notable, must be contextualized against the extraordinary performance of the prior year. The operating margin (excluding other income) wa...

Read full news article

Indus Towers Ltd Hits Intraday High with 3.54% Surge on 3 Feb 2026

2026-02-03 12:00:52Indus Towers Ltd demonstrated robust intraday performance on 3 February 2026, surging to an intraday high of ₹449.6, marking a 4.05% increase from its previous close. The stock’s upward momentum was supported by sustained gains over the past two sessions and trading above key moving averages, reflecting positive market sentiment within the telecom equipment sector.

Read full news article

Indus Towers Q3 FY26: Profit Declines 55.64% YoY Despite Revenue Growth

2026-02-02 21:16:45Indus Towers Limited, India's largest telecom infrastructure provider with a market capitalisation of ₹1.12 lakh crores, reported a concerning decline in profitability for Q3 FY26 despite maintaining revenue momentum. The company posted a consolidated net profit of ₹1,775.90 crores for the quarter ended December 2025, representing a sharp 55.64% year-on-year decline from ₹4,003.20 crores in Q3 FY25. Sequentially, net profit fell 3.45% from ₹1,839.30 crores in Q2 FY26. The stock reacted positively to the results, gaining 1.89% to close at ₹432.10 on February 2, 2026, as investors focused on the company's revenue growth and operational efficiency metrics.

Read full news article

Indus Towers Ltd Hits Intraday Low Amid Price Pressure on 1 Feb 2026

2026-02-01 12:01:07Indus Towers Ltd experienced a notable intraday decline on 1 Feb 2026, touching a low of Rs 428, reflecting a 3.59% drop from its previous close. The stock underperformed its sector and broader market indices amid subdued market sentiment and immediate selling pressures.

Read full news articleIndus Towers Gains 7.18%: 3 Key Factors Driving the Week’s Momentum

2026-01-31 17:09:09

Key Events This Week

Jan 27: Significant open interest surge amid mixed market signals

Jan 28: Technical momentum shifts with mildly bullish indicators

Jan 29: Intraday high reached with 3.4% surge

Jan 30: Week closes at Rs.443.95 (+7.18%)

Why is Indus Towers Ltd falling/rising?

2026-01-30 00:45:41

Impressive Price Momentum and Market Outperformance

Indus Towers Ltd has demonstrated remarkable price momentum recently, gaining 6.65% over the past three consecutive trading days. This upward trajectory culminated in the stock touching an intraday high of ₹442.5, a 4.06% increase on the day. Notably, the current price is just 3% shy of its 52-week high of ₹455, signalling sustained bullish sentiment among market participants. The stock’s performance has outpaced its sector peers, outperforming the Telecommunication - Equipment sector by 1.36% on the day, while the sector itself gained 2.49%. Such relative strength highlights Indus Towers’ leadership position within its industry segment.

Strong Returns Against Benchmark Indices

Over various tim...

Read full news article

Indus Towers Ltd Hits Intraday High with 3.4% Surge on 29 Jan 2026

2026-01-29 13:01:24Indus Towers Ltd demonstrated robust intraday strength on 29 Jan 2026, surging to an intraday high of Rs 439, marking a 3.23% rise and closing the day with a 3.4% gain. This performance outpaced the broader telecom equipment sector and the Sensex, underscoring the stock’s resilience amid a largely subdued market.

Read full news articleAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

03-Feb-2026 | Source : BSEIndus Towers Limited has informed the Exchange regarding the link of Audio Recording of the Earnings Call on the Companys performance for the third quarter (Q3) ended December 31 2025

Board Meeting Outcome for Outcome Of Board Meeting - Financial Results For The Third Quarter (Q3) And Nine Months Ended December 31 2025

02-Feb-2026 | Source : BSEIndus Towers Limited has informed to the Exchange regarding Outcome of Board Meeting pertaining to Financial Results for the third quarter (Q3) and nine months ended December 31 2025.

Financial Results For The Third Quarter (Q3) And Nine Months Ended December 31 2025

02-Feb-2026 | Source : BSEIndus Towers Limited has informed the Exchange regarding Financial Results for the third quarter (Q3) and nine months ended December 31 2025

Corporate Actions

No Upcoming Board Meetings

Indus Towers Ltd has declared 110% dividend, ex-date: 13 May 22

No Splits history available

No Bonus history available

No Rights history available