When is the next results date for Infronics Systems Ltd?

2026-02-12 23:16:36The next results date for Infronics Systems Ltd is scheduled for 14 February 2026....

Read full news article

Infronics Systems Ltd Falls to 52-Week Low Amidst Continued Underperformance

2026-02-10 11:07:14Infronics Systems Ltd, a player in the Software Products sector, has recorded a fresh 52-week low of Rs.17.66 today, marking a significant decline in its share price amid a sustained downward trajectory over recent sessions.

Read full news article

Infronics Systems Ltd Falls to 52-Week Low of Rs.19 Amid Continued Downtrend

2026-01-28 10:40:33Infronics Systems Ltd, a player in the Software Products sector, has touched a new 52-week low of Rs.19 today, marking a significant decline amid a sustained downward trend. The stock has underperformed its sector and benchmark indices, reflecting ongoing pressures on its financial and market performance.

Read full news article

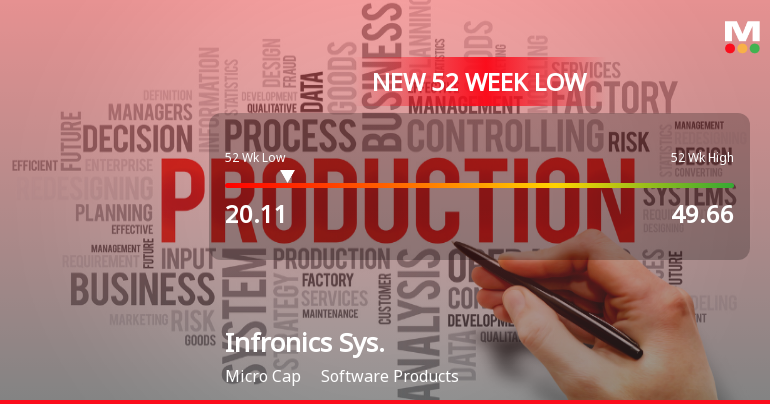

Infronics Systems Ltd Falls to 52-Week Low Amidst Continued Underperformance

2026-01-20 11:51:10Infronics Systems Ltd, a player in the Software Products sector, touched a new 52-week low of Rs.20.11 today, marking a significant decline in its share price amid a challenging market environment and ongoing financial pressures.

Read full news article

Infronics Systems Ltd Falls to 52-Week Low of Rs.21.42 Amid Continued Downtrend

2026-01-19 12:11:21Infronics Systems Ltd, a player in the Software Products sector, has touched a new 52-week low of Rs.21.42 today, marking a significant decline amid ongoing market pressures and company-specific headwinds. The stock has underperformed its sector and benchmark indices, reflecting persistent challenges in its financial and market performance.

Read full news article

Infronics Systems Ltd is Rated Strong Sell

2025-12-26 15:12:32Infronics Systems Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 24 September 2024. However, the analysis and financial metrics discussed here reflect the company’s current position as of 26 December 2025, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

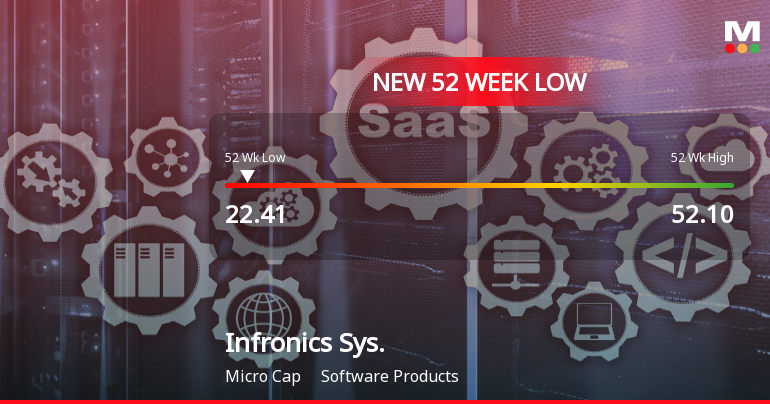

Infronics Systems Falls to 52-Week Low of Rs.22.41 Amidst Prolonged Underperformance

2025-12-22 15:35:11Infronics Systems, a player in the Software Products sector, has reached a new 52-week low of Rs.22.41 today, marking a significant milestone in its recent market trajectory. This development comes despite a modest gain of 2.07% over the past two days, with the stock still trading below all key moving averages.

Read full news article

Infronics Systems Stock Falls to 52-Week Low of Rs.22.56 Amidst Continued Downtrend

2025-12-12 10:16:40Infronics Systems, a player in the Software Products sector, has reached a fresh 52-week low of Rs.22.56 today, marking a significant milestone in its ongoing price decline. The stock has experienced a sustained downward trajectory over recent sessions, reflecting a challenging period for the company amid broader market dynamics.

Read full news article

Infronics Sys. Evaluation Revised Amidst Challenging Financial and Market Conditions

2025-12-09 10:10:07Infronics Sys., a microcap player in the Software Products sector, has undergone a revision in its evaluation metrics reflecting ongoing challenges in its financial performance and market positioning. This shift highlights key changes across quality, valuation, financial trends, and technical outlook, providing investors with a clearer understanding of the company’s current standing.

Read full news articleAnnouncement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

28-Feb-2026 | Source : BSEIntimation of Resignation of Company Secretary & Compliance Officer of the Company.

Announcement under Regulation 30 (LODR)-Newspaper Publication

16-Feb-2026 | Source : BSEIn accordance with Regulation 30 and 47 of Listing Regulations please find enclosed herewith extract of Un-Audited Financial Results for the quarter ended December 31 2025 as published in the newspaper in Business Standard (English Newspaper) and Ninadam (Telugu Newspaper) on February 16 2026.

Board Meeting Outcome for Board Meeting Outcome For Approval Of Un-Audited Financial Results For The Quarter Ended December 31 2025 Along With The Auditors Limited Review Report

14-Feb-2026 | Source : BSEPursuant to Regulation 30 and 33 of SEBI (Listing Obligation and Disclosure Requirements) Regulation 2015 (as amended) the meeting of the Board of Directors of the Company held on Saturday February 14 2026 at the registered office of the Company situated at Plot No. 30 31 Brigade Towers West Wing First Floor Nanakramguda Financial District Gachibowli Hyderabad Telangana - 500032 India inter alia considered and approved the Un-Audited Financial Results along with the Auditors Limited Review Report for the Quarter ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Infronics Systems Ltd has announced 10:5 stock split, ex-date: 05 Nov 15

No Bonus history available

No Rights history available