Is IRadimed Corp. overvalued or undervalued?

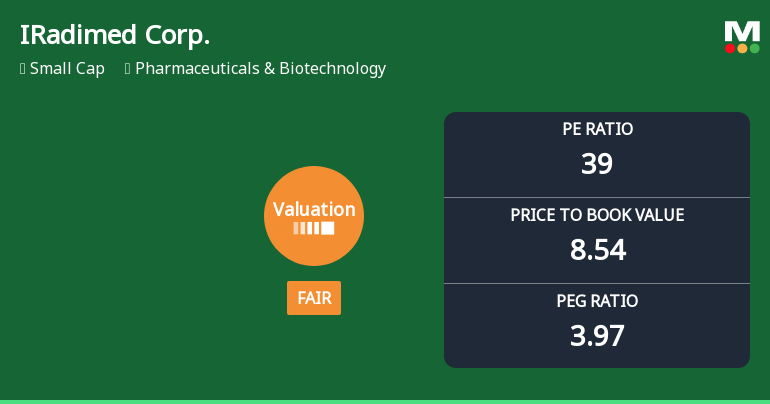

2025-11-23 11:12:09As of 21 November 2025, the valuation grade for IRadimed Corp. has moved from attractive to fair, indicating a shift in its perceived value. The company appears to be overvalued based on its current P/E ratio of 39, which is significantly higher than the industry average, and a PEG ratio of 3.97 that suggests limited growth potential relative to its price. Additionally, the Price to Book Value stands at 8.54, further supporting the notion of overvaluation. In comparison to peers, IRadimed Corp. has a P/E ratio of 44.24 for Artivion, Inc. and a negative P/E for BioLife Solutions, Inc., which highlights the relative valuation challenges IRadimed faces. The company's strong return metrics, including a 62.76% year-to-date return compared to the S&P 500's 12.26%, and a remarkable 206.37% return over three years, suggest that while the stock has performed well recently, its current valuation may not be justified...

Read full news article

IRadimed Corp. Hits New 52-Week High of $87.88, Up 104%

2025-11-05 16:47:48IRadimed Corp. has achieved a new 52-week high, reflecting its strong performance with a significant increase compared to the S&P 500. The company, valued at USD 914 million, showcases robust financial health, highlighted by a high return on equity and consistent positive results over the past year.

Read full news articleIs IRadimed Corp. overvalued or undervalued?

2025-11-05 11:11:49As of 31 October 2025, the valuation grade for IRadimed Corp. has moved from attractive to fair, indicating a shift in its perceived value. The company appears to be overvalued based on its current metrics, with a P/E ratio of 39, a Price to Book Value of 8.54, and an EV to EBITDA of 30.68, all of which are elevated compared to industry norms. In comparison, Artivion, Inc. has a significantly lower P/E ratio of -268.22, while BioLife Solutions, Inc. shows a negative EV to EBITDA of -77.88, highlighting IRadimed's relatively high valuation within its peer group. Despite the overvaluation, IRadimed Corp. has demonstrated strong performance, with a year-to-date return of 57.70%, significantly outperforming the S&P 500's return of 16.30% over the same period. This strong stock performance may suggest investor confidence, but the high valuation ratios indicate that caution is warranted....

Read full news article

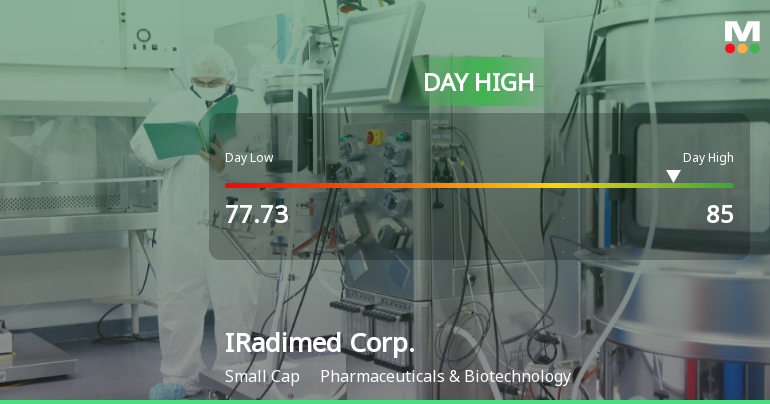

IRadimed Corp. Stock Soars 9.5%, Hits Intraday High of $85.00

2025-11-04 18:30:47IRadimed Corp., a small-cap company in the Pharmaceuticals & Biotechnology sector, has shown notable stock performance, with significant gains over various time frames. The company boasts strong financial metrics, including a high return on equity and positive operating cash flow, indicating solid management efficiency and market position.

Read full news article

IRadimed Corp. Hits New 52-Week High of $85.00, Up 97.91%

2025-11-04 17:58:27IRadimed Corp. has achieved a new 52-week high of USD 85.00, reflecting a strong one-year return of 97.91%. The company, with a market capitalization of USD 914 million, shows effective management through a 21.91% return on equity and robust operational performance, including significant cash flow and net sales.

Read full news article

IRadimed Corp. Experiences Revision in Its Stock Evaluation Amid Strong Market Performance

2025-11-03 16:04:13IRadimed Corp., a small-cap company in the Pharmaceuticals & Biotechnology sector, has recently adjusted its valuation metrics, including a P/E ratio of 39 and a PEG ratio of 3.97. The company has shown strong performance, with a return on capital employed of 56.93% and a return on equity of 21.97%.

Read full news articleIs IRadimed Corp. overvalued or undervalued?

2025-11-03 11:17:10As of 31 October 2025, the valuation grade for IRadimed Corp. has moved from attractive to fair, indicating a shift in its perceived value. The company appears to be overvalued based on its current metrics, with a P/E ratio of 39, a Price to Book Value of 8.54, and an EV to EBITDA of 30.68. In comparison, peers such as Artivion, Inc. and BioLife Solutions, Inc. show significantly less favorable ratios, with negative P/E ratios and high EV to EBITDA values, suggesting that IRadimed Corp. is trading at a premium relative to its industry. Despite the overvaluation, IRadimed Corp. has demonstrated strong performance with a year-to-date return of 39.65%, significantly outperforming the S&P 500's return of 16.30% over the same period. This performance, along with a high ROCE of 56.93% and ROE of 21.97%, reflects the company's operational efficiency, but the elevated valuation ratios indicate that the stock may n...

Read full news articleIs IRadimed Corp. overvalued or undervalued?

2025-11-02 11:10:14As of 31 October 2025, the valuation grade for IRadimed Corp. has moved from attractive to fair, indicating a shift in its perceived value. The company is currently fairly valued based on its financial metrics. The P/E ratio stands at 39, while the Price to Book Value is 8.54, and the EV to EBITDA ratio is 30.68. In comparison to its peers, IRadimed Corp. has a P/E ratio of 44.24, which is higher than the industry average, suggesting it may be overvalued relative to its competitors. For instance, Artivion, Inc. has a negative P/E ratio, while BioLife Solutions, Inc. also shows a negative figure, indicating challenges in those companies. Despite this, IRadimed Corp. has demonstrated strong returns, with a year-to-date return of 39.65% compared to the S&P 500's 16.30%, and a 5-year return of 239.12% against the S&P 500's 109.18%....

Read full news article