ITL Industries Ltd Downgraded to Strong Sell Amidst Weak Fundamentals and Valuation Concerns

2026-02-11 08:02:01ITL Industries Ltd has been downgraded from a Sell to a Strong Sell rating by MarketsMOJO as of 10 Feb 2026, reflecting deteriorating quality metrics, flat recent financial performance, and subdued market returns. Despite a discount valuation, the company’s weak long-term fundamentals and technical signals have prompted a cautious stance among investors.

Read full news article

ITL Industries Ltd Quality Grade Downgrade Highlights Fundamental Challenges

2026-02-11 08:00:09ITL Industries Ltd, a key player in the industrial manufacturing sector, has recently seen its quality grade downgraded from average to below average, accompanied by a Mojo Grade shift from Sell to Strong Sell. This article delves into the underlying business fundamentals, analysing key financial metrics such as return on equity (ROE), return on capital employed (ROCE), debt levels, and growth consistency to understand the factors driving this change.

Read full news articleAre ITL Industries Ltd latest results good or bad?

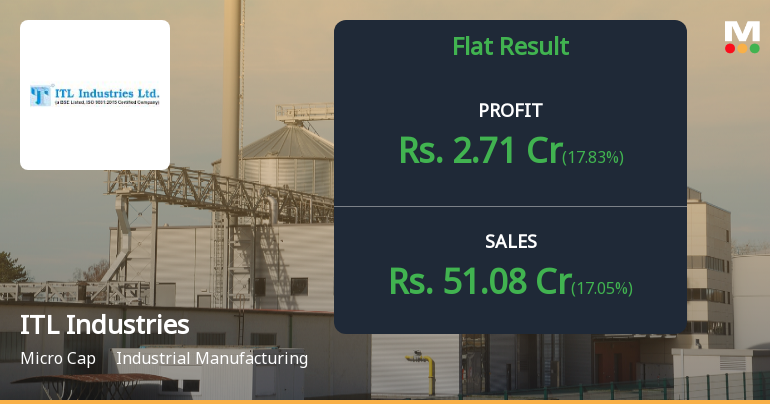

2026-02-10 19:25:25ITL Industries Ltd's latest financial results for Q3 FY26 indicate a mixed operational performance. The company reported net sales of ₹51.08 crores, reflecting a year-on-year growth of 17.05% compared to ₹43.64 crores in Q3 FY25. This growth, while notable, is sequentially lower than the ₹55.17 crores achieved in Q4 FY25. The net profit for the quarter stood at ₹2.71 crores, which is a 17.83% increase from ₹2.30 crores in the same quarter last year, suggesting improved profitability. The operating margin, excluding other income, reached 8.67%, marking the highest level in recent quarters and indicating enhanced operational efficiency and cost management. The profit before tax also showed a sequential increase of 10.78%, highlighting a positive trend in operational performance. However, despite these operational improvements, the company faces challenges in capital efficiency, with return on equity (ROE) a...

Read full news article

ITL Industries Ltd is Rated Sell by MarketsMOJO

2026-02-10 10:10:48ITL Industries Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 June 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 10 February 2026, providing investors with an up-to-date view of its performance and outlook.

Read full news article

ITL Industries Q3 FY26: Steady Growth Amid Challenging Market Conditions

2026-02-09 20:30:40ITL Industries Ltd., a micro-cap industrial manufacturing company specialising in band saw machines and CNC tube mills, reported a consolidated net profit of ₹2.71 crores for Q3 FY26 (October-December 2025), marking a modest 6.27% sequential increase from ₹2.55 crores in Q2 FY26 and a 17.83% year-on-year gain from ₹2.30 crores in Q3 FY25. Despite this steady operational performance, the stock has remained under severe pressure, currently trading at ₹289.10 with a market capitalisation of just ₹86.00 crores—down 36.46% from its 52-week high of ₹455.00 and reflecting a prolonged bearish trend that began in August 2025.

Read full news articleAre ITL Industries Ltd latest results good or bad?

2026-02-09 19:15:11The latest financial results for ITL Industries Ltd for the quarter ending September 2025 present a mixed operational picture. The company reported consolidated net sales of ₹48.61 crores, reflecting a year-on-year growth of 11.31% compared to ₹43.67 crores in the same quarter last year. This growth follows a notable sequential recovery from a decline in the previous quarter, indicating some stabilization in revenue generation. Consolidated net profit for the same period was ₹2.55 crores, which represents a substantial year-on-year increase of 25.00%, up from ₹2.04 crores in the prior year. This improvement in profitability suggests that the company has managed to enhance its earnings despite ongoing challenges in capital efficiency and margin pressures. However, the operating margin, excluding other income, was reported at 7.94%, which indicates a decline of 63 basis points from the previous quarter. Thi...

Read full news article

ITL Industries Ltd Stock Falls to 52-Week Low of Rs.243.75

2026-02-01 14:05:09ITL Industries Ltd touched a fresh 52-week low of Rs.243.75 today, marking a significant decline in its share price amid ongoing subdued performance and market volatility. The stock’s fall to this level reflects persistent challenges in sustaining growth and investor confidence within the industrial manufacturing sector.

Read full news article

ITL Industries Ltd is Rated Sell

2026-01-30 10:11:02ITL Industries Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 June 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

ITL Industries Ltd Stock Falls to 52-Week Low of Rs.246.05

2026-01-27 11:25:25ITL Industries Ltd has reached a new 52-week low of Rs.246.05, marking a significant decline in its stock price amid broader market weakness and sector underperformance. The stock’s recent slide reflects ongoing challenges in maintaining growth momentum within the industrial manufacturing sector.

Read full news articleBoard Meeting Outcome for Submission Of Outcome Of Board Meeting Of The Company Held On Monday February 9 2026

09-Feb-2026 | Source : BSEDear Sir In continuation of our previous letter dated January 31 2026 regarding intimation of Board Meeting in this connection We have to inform you that the Board of Director of the Company at its meeting held today i.e. Monday February 9 2026 at the Registered Office of the Company has inter alia to considered and approved following business:- 1. The Standalone and Consolidated Un-audited financial results of the Company for the Quarter/ Nine Months ended December 31 2025. 2. Taken on Record the Limited Review Report by the Statutory Auditors for the Un-audited financial results of the Company for the Quarter/ Nine Months ended December 31 2025. 3. Other routine business.

Standalone And Consolidated Un-Audited Financial Results For The Quarter/Nine Months Ended On December 31 2025.

09-Feb-2026 | Source : BSEwe are submitting herewith standalone and consolidated un-audited financial results for the quarter/nine months ended on December 31 2025 with Limited Review.

Board Meeting Intimation for To Consider & Approve The Standalone And Consolidated Un-Audited Financial Results Of The Company For The Quarter/ Nine Months Ended December 31 2025

31-Jan-2026 | Source : BSEITL Industries Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve 1. To consider & approve the Standalone and Consolidated Un-audited financial results of the Company for the Quarter/ Nine Months ended December 31 2025. 2. To take on Record the Limited Review Report by the Auditors for the Un-audited financial results of the Company for the Quarter/ Nine Months ended December 31 2025. 3. Any other item may be taken up for consideration with the permission of the Chairman and with the consent of a majority of the Directors present in the Meeting which shall include at least one Independent Director if any.

Corporate Actions

No Upcoming Board Meetings

ITL Industries Ltd has declared 10% dividend, ex-date: 23 Sep 25

No Splits history available

No Bonus history available

No Rights history available