JanOne, Inc. Hits New 52-Week Low at $1.09 Amid Ongoing Struggles

2025-12-31 16:14:29JanOne, Inc. has reached a new 52-week low, reflecting a substantial decline in its stock performance over the past year. The company faces ongoing financial challenges, including negative operating cash flow and decreasing net sales, raising concerns about its long-term viability and overall financial health.

Read full news article

JanOne, Inc. Hits 52-Week Low as Stock Plummets to $1.10

2025-12-25 16:05:27JanOne, Inc. has reached a new 52-week low, trading at USD 1.10, reflecting a significant decline of nearly 56% over the past year. The company faces ongoing financial challenges, including negative returns on equity and cash flow, alongside a notable drop in profits and a negative EBITDA.

Read full news article

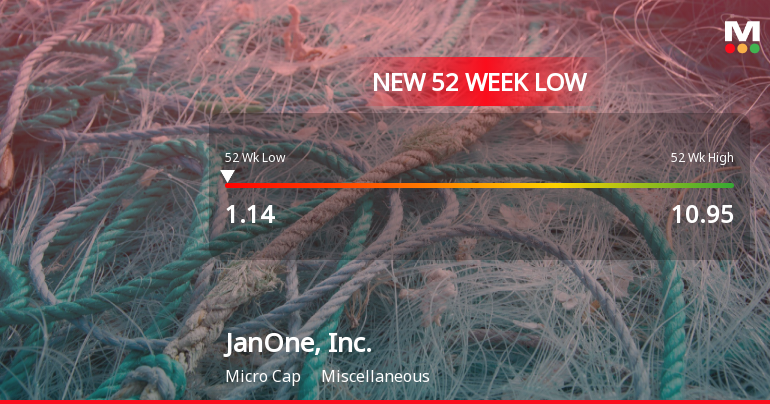

JanOne, Inc. Stock Plummets to New 52-Week Low of $1.14

2025-12-24 16:33:33JanOne, Inc. has reached a new 52-week low, reflecting a significant decline in stock performance over the past year. The company, with a market capitalization of USD 502 million, is facing financial challenges, including declining net sales and operating profit, and has reported losses for the last two quarters.

Read full news article

JanOne, Inc. Hits 52-Week Low as Stock Plummets to $1.20

2025-12-23 16:26:10JanOne, Inc. has reached a new 52-week low, reflecting a challenging year with a significant performance decline. The company faces operational losses, declining net sales, and a high debt-equity ratio, indicating financial difficulties. Its recent financial results show negative cash flow and increased interest expenses, highlighting ongoing struggles.

Read full news article

JanOne, Inc. Hits New 52-Week Low at $1.22 Amid Declining Sales

2025-12-18 16:57:45JanOne, Inc. has reached a new 52-week low, reflecting a challenging year with a significant stock price decline. The company operates at a loss, with declining net sales and operating profit. Its financial metrics indicate potential difficulties, raising concerns about its long-term viability in the market.

Read full news article

JanOne, Inc. Hits New 52-Week Low at $1.23 Amid Ongoing Struggles

2025-12-17 16:39:00JanOne, Inc. has reached a new 52-week low, reflecting a significant decline in its stock performance over the past year. The company, with a market capitalization of USD 502 million, is facing operational losses, negative cash flow, and declining net sales, indicating ongoing financial challenges.

Read full news article

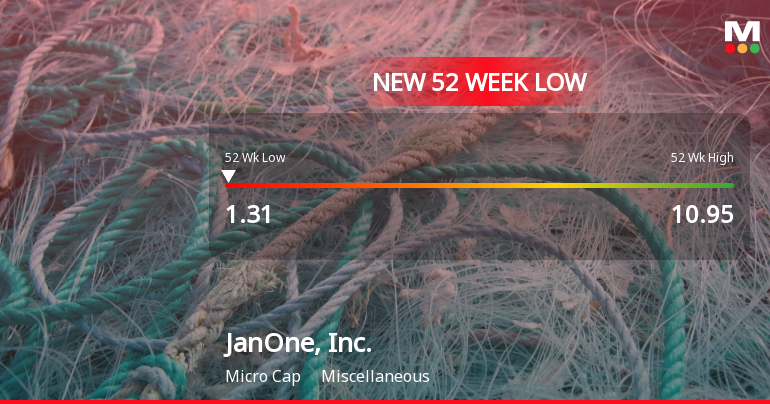

JanOne, Inc. Hits New 52-Week Low at $1.31 Amid Declining Performance

2025-12-16 16:38:26JanOne, Inc. has reached a new 52-week low, reflecting a difficult year marked by a substantial decline in stock price. The company faces ongoing financial challenges, including negative operating cash flow and a low return on equity, indicating struggles in generating positive cash from operations amidst a challenging market environment.

Read full news article

JanOne, Inc. Hits New 52-Week Low at $1.35 Amid Declining Sales

2025-12-11 16:26:01JanOne, Inc. has reached a new 52-week low, reflecting a significant decline in its performance over the past year. The company faces operational challenges, including negative returns on equity and declining net sales. Additionally, it has reported consecutive quarters of losses and struggles with cash flow and debt management.

Read full news article

JanOne, Inc. Hits New 52-Week Low at $1.42 Amid Declining Performance

2025-12-08 18:24:06JanOne, Inc. has reached a new 52-week low, reflecting a challenging year marked by a significant stock price decline. The company has reported negative financial results, including a low return on equity and declining net sales, alongside rising interest expenses, indicating ongoing operational difficulties.

Read full news article