Key Events This Week

Feb 9: Stock opens at Rs.69.25, up 1.85% on strong market sentiment

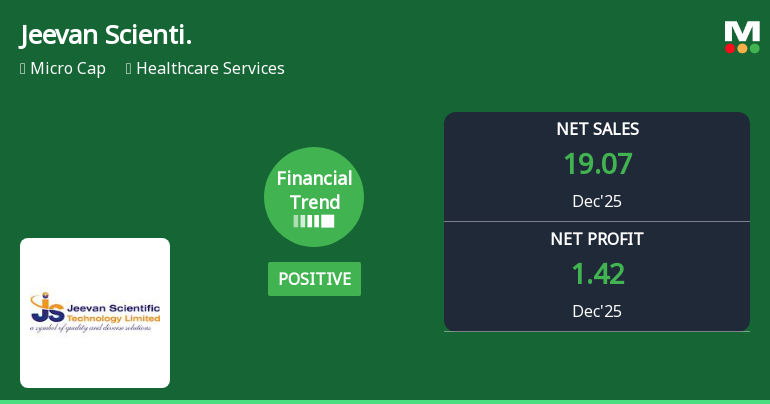

Feb 11: Q3 FY26 results reveal strong revenue surge but raise profitability concerns

Feb 12: Company reports a strong quarterly financial turnaround with record margins

Feb 13: Week closes at Rs.69.00, outperforming Sensex which fell 1.40%