Key Events This Week

5 Jan: Downgrade to Sell by MarketsMOJO amid mixed fundamentals and technical signals

5 Jan: Technical momentum shifts from bullish to mildly bullish

8 Jan: Stock rebounds 2.67% on heavy volume despite Sensex decline

9 Jan: Sharp decline of 4.48% closes the week at ₹949.90

Jindal Poly Investment & Finance Company Ltd Downgraded to Sell Amid Mixed Fundamentals and Technical Signals

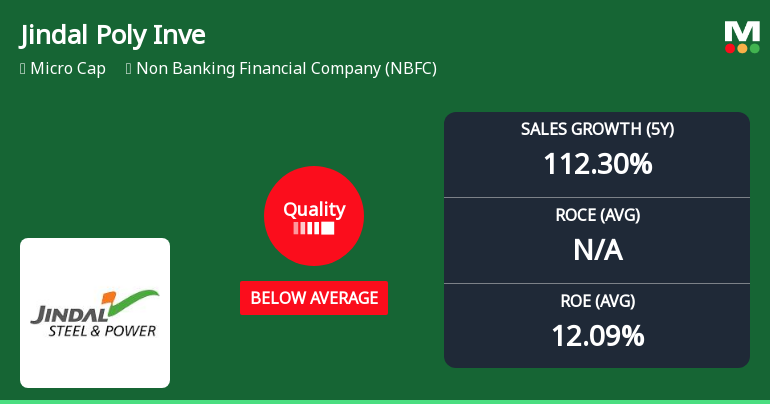

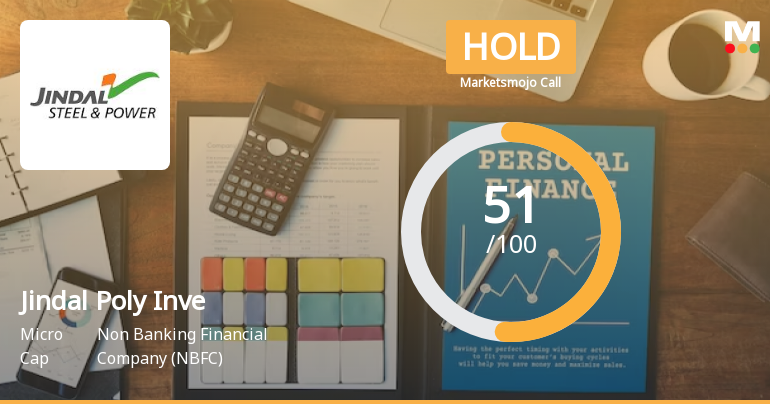

2026-01-05 08:04:05Jindal Poly Investment & Finance Company Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has seen its investment rating downgraded from Hold to Sell as of 2 January 2026. This shift reflects a complex interplay of factors including a deterioration in technical indicators, flat financial performance in the recent quarter, and valuation considerations, despite a historically strong long-term return profile.

Read full news article

Jindal Poly Investment & Finance Company Ltd Sees Technical Momentum Shift Amid Mixed Signals

2026-01-05 08:03:47Jindal Poly Investment & Finance Company Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has experienced a notable shift in its technical momentum, moving from a bullish to a mildly bullish stance. Despite a recent downgrade in its Mojo Grade from Hold to Sell, the stock’s technical indicators present a complex picture, with some metrics signalling strength while others suggest caution. This article analyses the latest price movements, technical indicators, and market context to provide a comprehensive view for investors.

Read full news article

Jindal Poly Investment & Finance Company Ltd is Rated Hold

2026-01-02 10:10:32Jindal Poly Investment & Finance Company Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 08 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 02 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Jindal Poly Inve Sees Revision in Market Assessment Amid Mixed Financial Signals

2025-12-22 10:10:52Jindal Poly Inve, a microcap player in the Non Banking Financial Company (NBFC) sector, has experienced a revision in its market evaluation reflecting nuanced shifts across key analytical parameters. This adjustment highlights a complex interplay of valuation appeal, financial performance, and technical momentum, offering investors a detailed perspective on the stock’s current standing.

Read full news articleIs Jindal Poly Inve overvalued or undervalued?

2025-12-04 08:29:30

Understanding Jindal Poly Inve’s Valuation Metrics

At a price-to-earnings (PE) ratio of approximately 5.4, Jindal Poly Inve trades at a significant discount compared to many of its NBFC peers. This low PE ratio suggests the stock is relatively inexpensive in terms of earnings. The price-to-book (P/B) value stands at 0.72, indicating the market values the company below its book value, which can be a sign of undervaluation or market scepticism about asset quality or future growth.

However, enterprise value (EV) multiples such as EV to EBIT and EV to EBITDA are notably high, both around 28.2 times. These elevated multiples contrast with the low PE and P/B ratios, signalling that while earnings are cheap, the company’s operational cash flow and capital structure might be p...

Read full news article