Recent Price Movement and Market Context

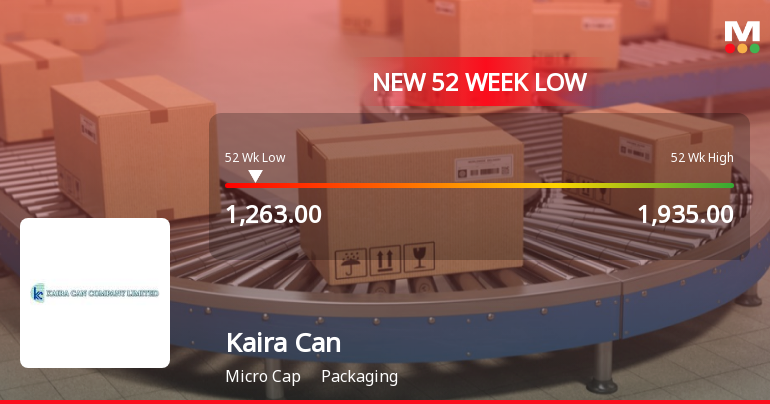

The stock's fall on 24-Feb was marked by an opening gap down of 4.87%, setting a bearish tone for the trading session. Intraday, the share touched a low of ₹1,371.25, reflecting persistent selling pressure. The narrow trading range of just ₹8.75 during the day suggests limited volatility but a clear downward bias. This price action contrasts sharply with the broader market, as the Sensex posted gains over the past month and year, while Kaira Can’s stock has consistently lagged behind.

Over the past week, the stock has declined by 5.80%, significantly underperforming the Sensex’s modest 1.47% loss. Similarly, on a one-month basis, Kaira Can fell 2.81% while the Sensex gained 0.84%. Year-to-date, the stock is down 4.83%, exceeding...

Read full news article