Key Events This Week

2 Feb: Downgrade to Sell on mixed technical and valuation signals

3 Feb: Bearish momentum intensifies amid technical downgrade

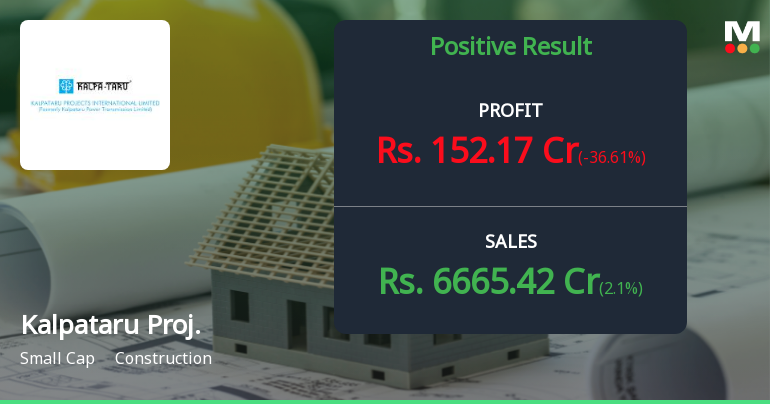

4 Feb: Q3 FY26 results show profit growth stalls amid margin pressure

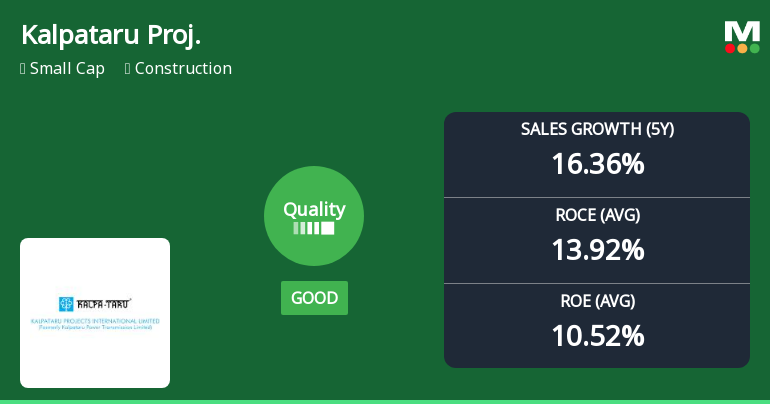

6 Feb: Quality grade upgraded; rating revised to Hold on improved fundamentals