Key Events This Week

Jan 19: Downgrade to Sell rating amid technical weakness

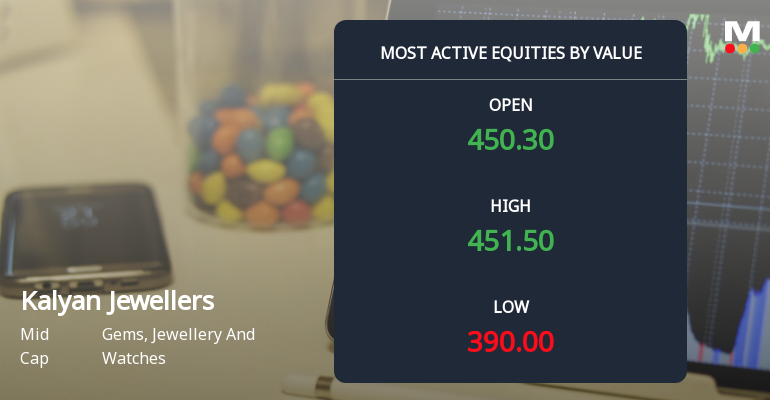

Jan 20: Bearish momentum confirmed with price drop to Rs.451.60

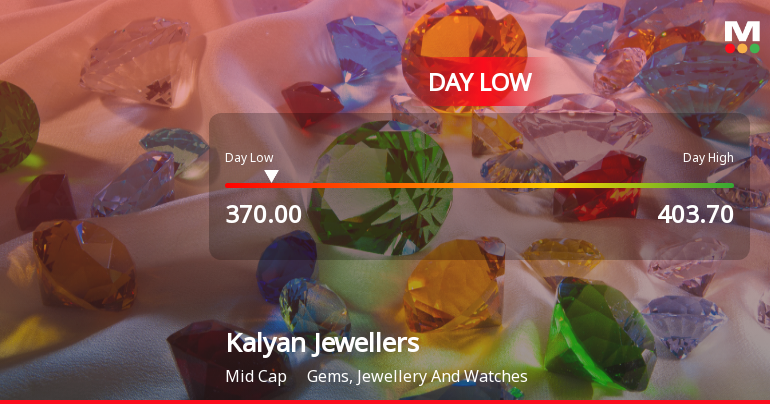

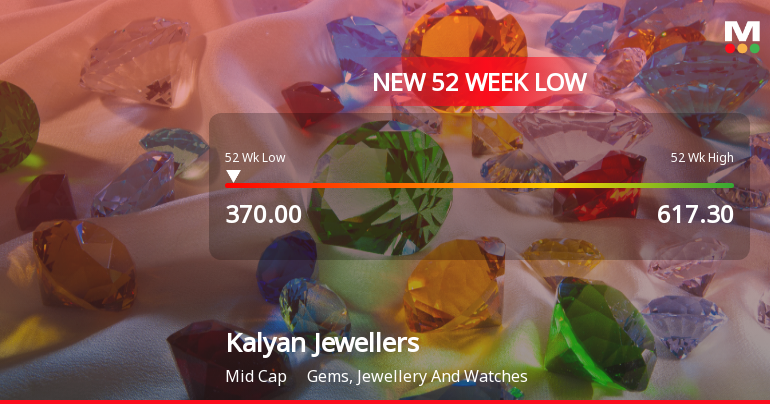

Jan 21: Stock hits 52-week low of Rs.390 amid heavy selling

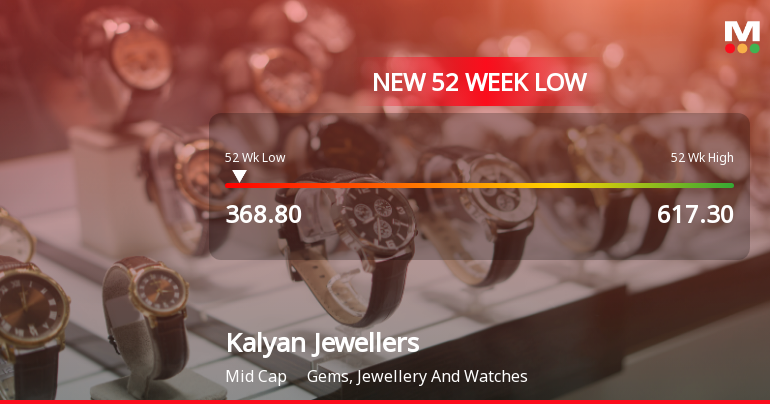

Jan 22: New 52-week low of Rs.387 recorded

Jan 23: Week closes at Rs.367.45, down 1.70% on day