Key Events This Week

2 Feb: Stock opens at Rs.4,564.60, down 2.88%

3 Feb: Sharp rebound with 4.41% gain following technical upgrade

4 Feb: Mixed technical signals amid price momentum shift, stock closes Rs.4,778.90

6 Feb: Week closes at Rs.4,784.00, up 1.79% for the week

When is the next results date for Kalyani Investment Company Ltd?

2026-02-06 23:17:57The next results date for Kalyani Investment Company Ltd is scheduled for 13 February 2026....

Read full news article

Kalyani Investment Company Ltd Upgraded to Sell on Technical Improvements

2026-02-04 08:15:19Kalyani Investment Company Ltd has seen its investment rating upgraded from Strong Sell to Sell, driven primarily by a shift in technical indicators despite persistent fundamental weaknesses. The company’s technical grade improved from bearish to mildly bearish, prompting a reassessment of its near-term outlook. However, valuation and financial trends remain subdued, reflecting ongoing challenges in profitability and cash flow generation.

Read full news article

Kalyani Investment Company Ltd Sees Mixed Technical Signals Amid Price Momentum Shift

2026-02-04 08:02:36Kalyani Investment Company Ltd (NSE: 485202), a key player in the Non Banking Financial Company (NBFC) sector, has exhibited a notable shift in its technical momentum, moving from a strongly bearish stance to a more nuanced mildly bearish outlook. Despite a robust day change of 4.06%, the company’s technical indicators present a complex picture, with mixed signals from MACD, RSI, moving averages, and other momentum oscillators. This article delves into the detailed technical analysis and market context to provide investors with a comprehensive understanding of the stock’s current positioning and future prospects.

Read full news articleKalyani Investment Company Ltd’s 0.28% Weekly Dip Amid Bearish Technical Shift

2026-01-31 17:06:46

Key Events This Week

Jan 23: Downgrade to Strong Sell rating announced

Jan 27: Stock declines 1.22% amid bearish technical momentum

Jan 28: Intraday recovery lifts stock 1.71%

Jan 29: Price retreats 1.16% despite Sensex gains

Jan 30: Week closes at Rs.4,699.95, down 0.28% for the week

Kalyani Investment Company Ltd Faces Bearish Momentum Amid Technical Downturn

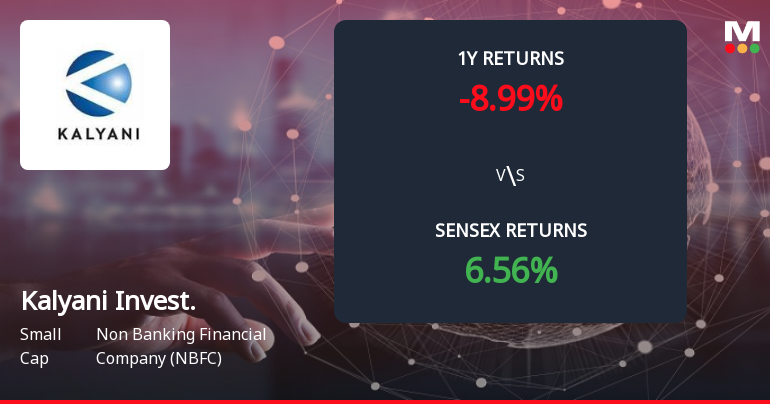

2026-01-27 08:01:30Kalyani Investment Company Ltd, a prominent player in the Non Banking Financial Company (NBFC) sector, has seen a notable shift in its technical momentum, with key indicators signalling a bearish trend. The company’s MarketsMOJO grade has been downgraded from Sell to Strong Sell as of 23 Jan 2026, reflecting growing concerns over its price action and underlying market sentiment.

Read full news article

Kalyani Investment Company Ltd Downgraded to Strong Sell Amid Weak Fundamentals and Bearish Technicals

2026-01-26 08:07:53Kalyani Investment Company Ltd has been downgraded from a Sell to a Strong Sell rating as of 23 January 2026, reflecting deteriorating technical indicators and stagnant financial performance. Despite a historically strong long-term return, recent quarters have shown flat results and weakening profitability, prompting a reassessment of the stock’s investment appeal.

Read full news articleKalyani Investment Company Ltd Falls 2.58%: 3 Key Factors Driving the Weekly Decline

2026-01-24 17:07:26

Key Events This Week

Jan 19: Stock declines 3.89% amid broad market weakness

Jan 22: Intraday high and gap up of 7.06% to Rs.4,899.95

Jan 23: Formation of Death Cross signalling bearish trend

Jan 23: Week closes at Rs.4,713.25 (-2.58%)

Kalyani Investment Company Ltd Forms Death Cross Signalling Bearish Trend

2026-01-23 18:00:39Kalyani Investment Company Ltd, a Non Banking Financial Company (NBFC), has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and long-term weakness in the stock’s price action.

Read full news articleBoard Meeting Intimation for Board Meeting Intimation For Considering And Approving The Unaudited Financial Results (Standalone & Consolidated) For The Quarter And Nine Months Ended December 31 2025

05-Feb-2026 | Source : BSEKalyani Investment Company Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve the Unaudited Financial Results (Standalone & Consolidated) for the Quarter and Nine months ended December 31 2025

Announcement U/R 30 Of SEBI (LODR) Regulations 2015

03-Feb-2026 | Source : BSEAnnouncement U/R 30 of SEBI (LODR) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

12-Jan-2026 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter from October 1 2025 to December 31 2025

Corporate Actions

13 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available