Kesar Enterprises Ltd is Rated Strong Sell

2026-03-05 10:10:37Kesar Enterprises Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 07 Oct 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 05 March 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and overall outlook.

Read full news article

Kesar Enterprises Ltd Stock Falls to 52-Week Low of Rs.4.1 Amidst Continued Downtrend

2026-03-02 11:58:07Kesar Enterprises Ltd, a player in the sugar industry, recorded a new 52-week low of Rs.4.1 today, marking a significant decline in its stock price amid persistent underperformance relative to its sector and broader market indices.

Read full news article

Kesar Enterprises Ltd is Rated Strong Sell

2026-02-22 10:10:29Kesar Enterprises Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 07 October 2025. However, the analysis and financial metrics discussed below reflect the company’s current position as of 23 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleWhen is the next results date for Kesar Enterprises Ltd?

2026-02-11 23:16:31The next results date for Kesar Enterprises Ltd is scheduled for 13 February 2026....

Read full news article

Kesar Enterprises Ltd is Rated Strong Sell

2026-02-10 10:10:48Kesar Enterprises Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 07 October 2025. However, the analysis and financial metrics presented here reflect the company’s current position as of 10 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Kesar Enterprises Ltd is Rated Strong Sell

2026-01-30 10:11:02Kesar Enterprises Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 07 Oct 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 30 January 2026, providing investors with an up-to-date view of its fundamentals, returns, and overall outlook.

Read full news article

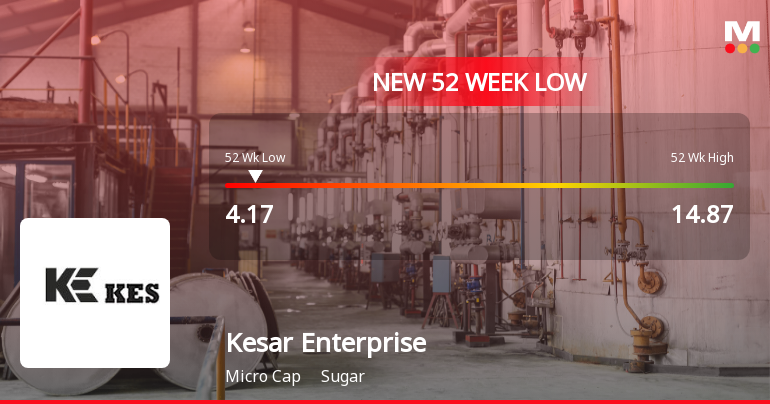

Kesar Enterprises Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-01-27 15:50:26Kesar Enterprises Ltd, a player in the sugar industry, has touched a new 52-week low of Rs.4.17 today, marking a significant decline amid a challenging market environment. The stock has underperformed its sector and broader indices, reflecting ongoing financial pressures and subdued operational metrics.

Read full news article

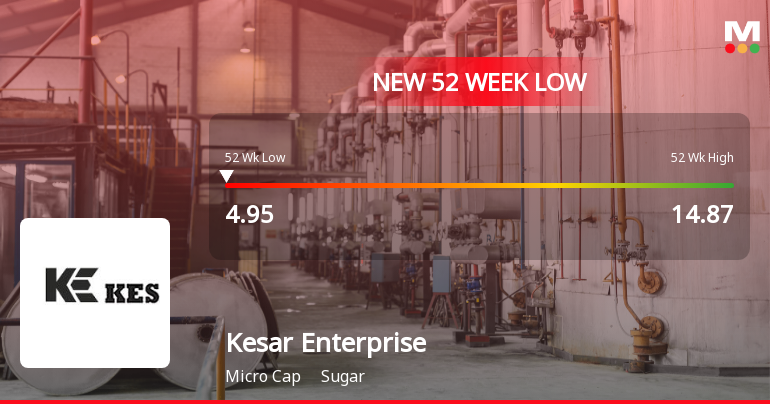

Kesar Enterprises Ltd Stock Falls to 52-Week Low of Rs.4.95

2026-01-23 14:43:01Kesar Enterprises Ltd, a player in the sugar industry, recorded a new 52-week low of Rs.4.95 today, marking a significant decline amid persistent downward momentum. The stock has now fallen for five consecutive sessions, shedding 16.67% over this period, reflecting ongoing pressures on the company’s financial and market performance.

Read full news article

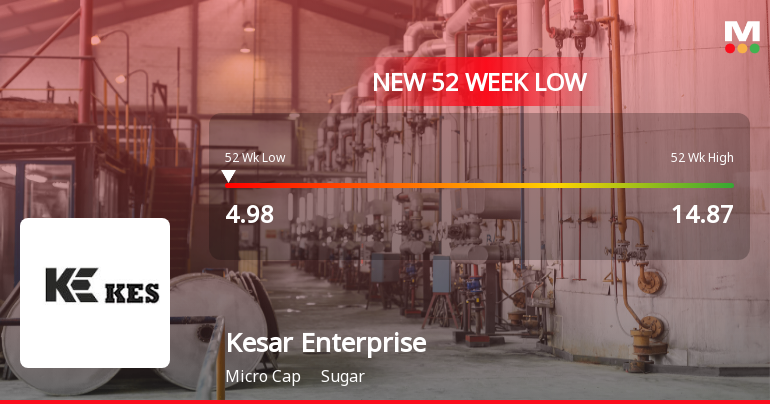

Kesar Enterprises Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-01-22 10:55:54Kesar Enterprises Ltd, a player in the sugar sector, has touched a fresh 52-week low of Rs.4.98 today, marking a significant decline in its stock price amid ongoing financial pressures and subdued market performance.

Read full news articleAnnouncement Under Regulation 30 Of LODR - Updates

27-Feb-2026 | Source : BSEThis is to inform you that the operations of Cogen Division of the Company at Baheri Uttar Pradesh have been closed for the season 2025-26.

Announcement Under Regulation 30 - LODR Updates

24-Feb-2026 | Source : BSEThis is to inform you that the Company has closed its crushing operations for the Sugar Season 2025-26 at its sugar factory located at Baheri Uttar Pradesh.

Announcement under Regulation 30 (LODR)-Newspaper Publication

16-Feb-2026 | Source : BSEPlease find enclosed herewith copy of relevant pages of newspapers Free Press Journal published on 15.02.2026 depicting unaudited financial results for the quarter ended on 31.12.2025

Corporate Actions

No Upcoming Board Meetings

Kesar Enterprises Ltd has declared 10% dividend, ex-date: 08 Nov 11

Kesar Enterprises Ltd has announced 1:10 stock split, ex-date: 18 Sep 25

No Bonus history available

No Rights history available