Keysight Technologies Experiences Valuation Adjustment Amid Competitive Electronics Sector Landscape

2025-11-17 15:40:53Keysight Technologies, Inc. has recently adjusted its valuation metrics, reporting a P/E ratio of 44 and a price-to-book value of 5.54. The company has shown a 16.51% stock return over the past year, outperforming the S&P 500, but lags in longer-term performance compared to the index.

Read full news articleIs Keysight Technologies, Inc. overvalued or undervalued?

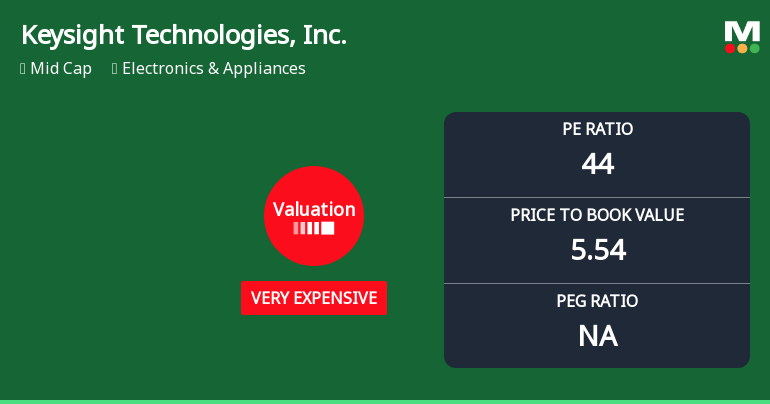

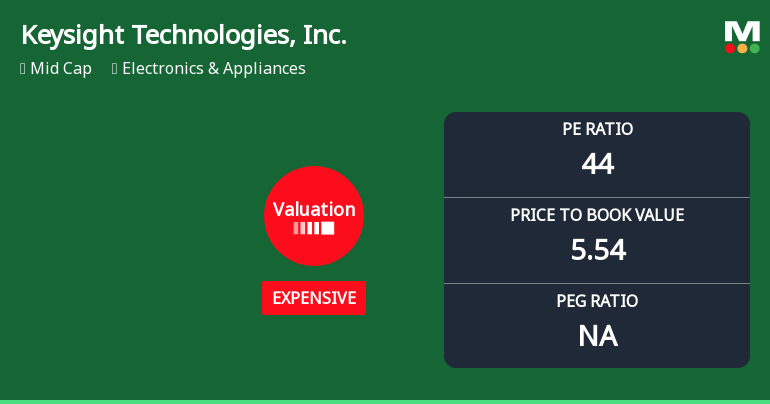

2025-11-11 11:33:29As of 7 November 2025, the valuation grade for Keysight Technologies, Inc. moved from very expensive to expensive. The company is currently considered overvalued based on its valuation ratios, which include a P/E ratio of 44, a Price to Book Value of 5.54, and an EV to EBITDA of 26.21. In comparison, peers such as Rockwell Automation, Inc. and Fortive Corp. have P/E ratios of 57.64 and 19.50, respectively, indicating that Keysight's valuation is relatively high within its industry. Despite the recent downgrade in valuation grade, the stock's performance against the S&P 500 remains unreported, which limits the ability to assess its relative market strength. Overall, the combination of high valuation ratios and the peer comparison suggests that Keysight Technologies, Inc. is overvalued at its current price of 183.51....

Read full news article

Keysight Technologies Experiences Valuation Adjustment Amid Competitive Market Landscape

2025-11-10 16:11:07Keysight Technologies, Inc. has recently adjusted its valuation, with its current price at $180.87, down from $185.05. Over the past year, the company has returned 9.50%, trailing the S&P 500's 12.65%. Its financial metrics indicate a competitive position within the Electronics & Appliances sector.

Read full news articleIs Keysight Technologies, Inc. overvalued or undervalued?

2025-11-09 11:08:45As of 7 November 2025, the valuation grade for Keysight Technologies, Inc. has moved from very expensive to expensive. The company appears to be overvalued based on its current valuation metrics. The P/E ratio stands at 44, significantly higher than peers such as Rockwell Automation, Inc. with a P/E of 57.64 and Fortive Corp. at 19.50. Additionally, Keysight's EV to EBITDA ratio is 26.21, which also exceeds the industry average, indicating a premium valuation compared to its competitors. In terms of returns, Keysight has underperformed relative to the S&P 500 over the longer term, with a 5-year return of 60.10% compared to the S&P's 91.73%. This disparity in performance, coupled with high valuation ratios, reinforces the conclusion that Keysight Technologies, Inc. is overvalued in the current market....

Read full news article

Keysight Technologies Hits New 52-Week High of $187.67

2025-11-07 16:05:28Keysight Technologies, Inc. achieved a new 52-week high of USD 187.67 on November 6, 2025, reflecting strong performance in the electronics sector with a one-year growth of 35.33%. The company has a market cap of USD 31,650 million and maintains solid financial metrics, including a P/E ratio of 44.00.

Read full news article

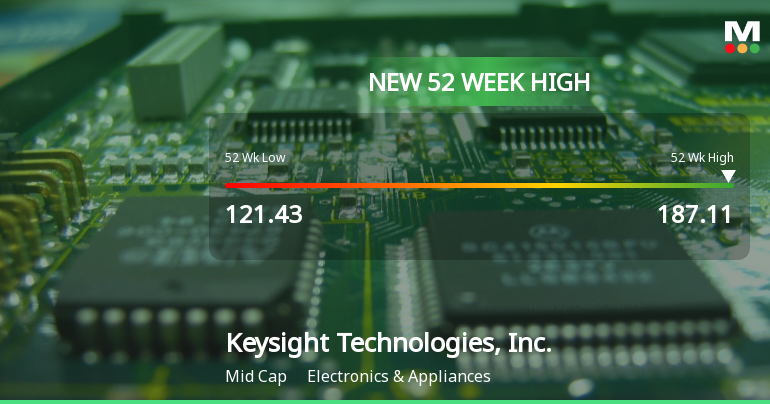

Keysight Technologies Hits New 52-Week High of $187.11

2025-11-04 17:55:26Keysight Technologies, Inc. achieved a new 52-week high of USD 187.11 on November 3, 2025, reflecting strong performance in the electronics sector with a one-year growth of 36.16%. The company has a market cap of USD 31.65 billion and a P/E ratio of 44.00, with no dividends offered.

Read full news article

Keysight Technologies Experiences Revision in Its Stock Evaluation Amid Competitive Market Landscape

2025-11-03 16:05:20Keysight Technologies, Inc. has recently adjusted its valuation, with a current P/E ratio of 44 and a price-to-book value of 5.54. The company has delivered notable year-to-date returns of 13.90% and 22.78% over the past year, although its long-term performance shows mixed results compared to the S&P 500.

Read full news article